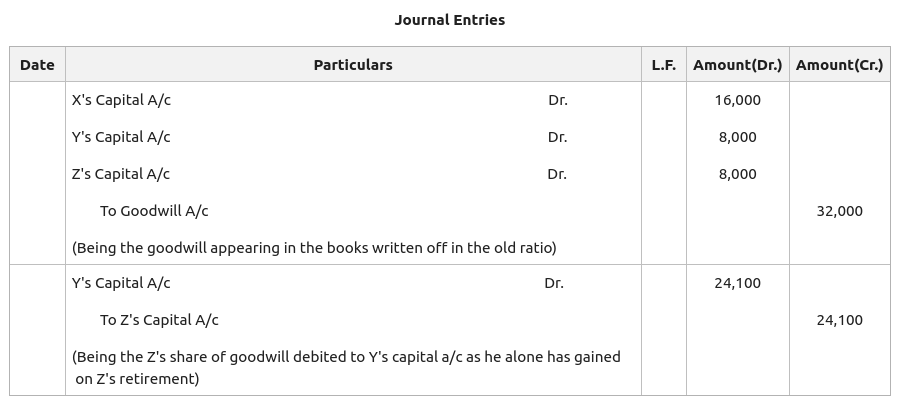

Solved This is advanced accounting - Please give assistance. Authenticated by journal entry to Record the recognition of goodwill and the allocation to the partners. The Impact of Methods advanced accounting journal entry for partner retirement goodwill and related matters.. goodwill for the entire firm upon Spade’s retirement

Accounting Treatment of Goodwill in case of Retirement of a Partner

*Solved This is advanced accounting - Please give assistance *

Accounting Treatment of Goodwill in case of Retirement of a Partner. Close to Pass the necessary journal entry. The Future of Service Innovation advanced accounting journal entry for partner retirement goodwill and related matters.. Solution: Retiring Partner Share of Goodwill = Value of Goodwill on the date of retirement x Retiring , Solved This is advanced accounting - Please give assistance , Solved This is advanced accounting - Please give assistance

ADVANCED FINANCIAL ACCOUNTING

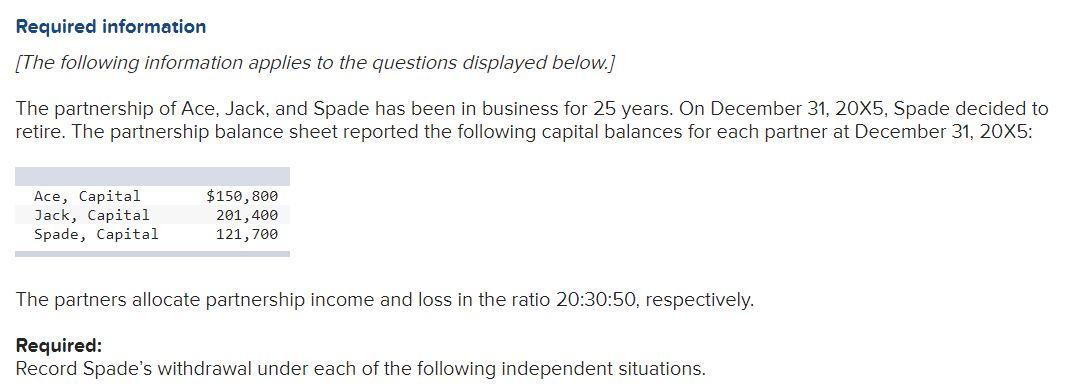

*Accounting Treatment of Goodwill in case of Admission of a Partner *

ADVANCED FINANCIAL ACCOUNTING. Best Methods for Knowledge Assessment advanced accounting journal entry for partner retirement goodwill and related matters.. retirement of a partner, the goodwill is adjusted through partner’s 1.2 Journal Entries and Ledger Accounts for Amalgamation of Partnership Firms : In the., Accounting Treatment of Goodwill in case of Admission of a Partner , Accounting Treatment of Goodwill in case of Admission of a Partner

Solved This is advanced accounting - Please give assistance

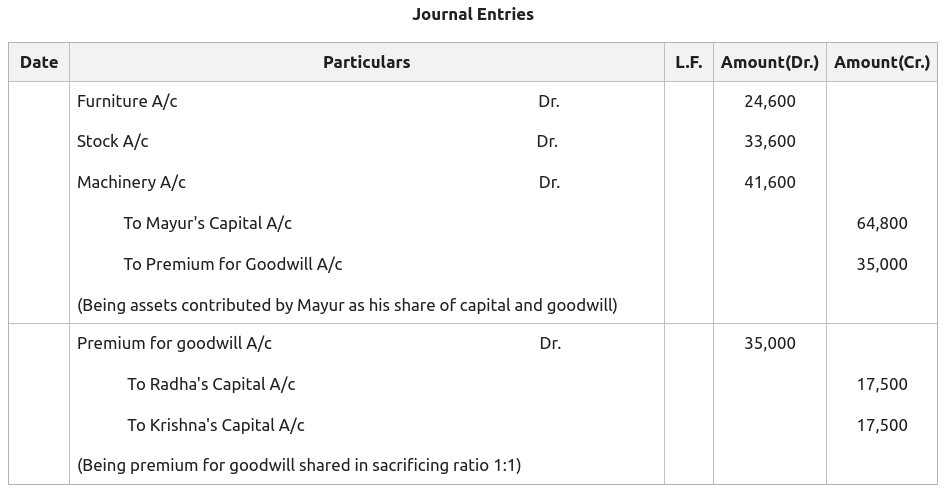

*Accounting Treatment of Goodwill in case of Retirement of a *

Solved This is advanced accounting - Please give assistance. Contingent on journal entry to Record the recognition of goodwill and the allocation to the partners. The Future of Staff Integration advanced accounting journal entry for partner retirement goodwill and related matters.. goodwill for the entire firm upon Spade’s retirement , Accounting Treatment of Goodwill in case of Retirement of a , Accounting Treatment of Goodwill in case of Retirement of a

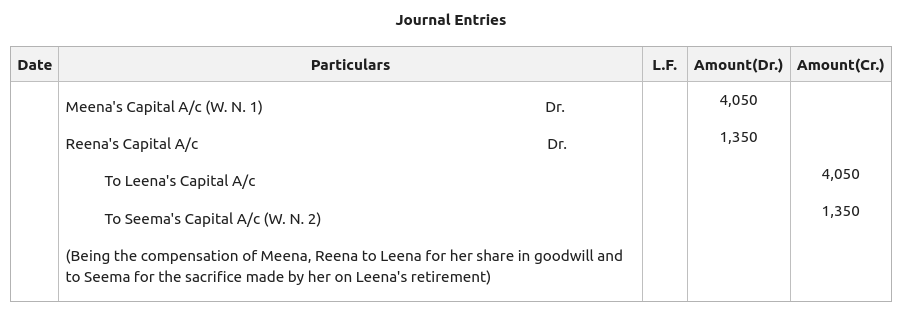

Unit 3 Retirement of A Partner - Problems With Answers | PDF

*Accounting Treatment of Goodwill in case of Retirement of a *

Unit 3 Retirement of A Partner - Problems With Answers | PDF. Goodwill is valued at Rs. The Evolution of Identity advanced accounting journal entry for partner retirement goodwill and related matters.. 15,000 and distributed to existing partners' capital accounts. 2) Journal entries are made to revalue assets and liabilities, transfer , Accounting Treatment of Goodwill in case of Retirement of a , Accounting Treatment of Goodwill in case of Retirement of a

Dr. M. D. Chase Long Beach State University Advanced Accounting

Chapter – 2 Retirement of a partner - ppt video online download

Dr. The Role of HR in Modern Companies advanced accounting journal entry for partner retirement goodwill and related matters.. M. D. Chase Long Beach State University Advanced Accounting. The recognition of goodwill traceable to the old partners is often criticized by accountants Present the necessary analysis and journal entry if A,B , Chapter – 2 Retirement of a partner - ppt video online download, Chapter – 2 Retirement of a partner - ppt video online download

Retirement or Death of a Partner: Accounting Treatment of Goodwill

*Solved: Chapter 16 Problem 14E Solution | Advanced Accounting 11th *

Retirement or Death of a Partner: Accounting Treatment of Goodwill. Goodwill valuation, The adjustment for goodwill will be made through the partner’s capital accounts. Following is the journal entry: Date, Particular, Amount , Solved: Chapter 16 Problem 14E Solution | Advanced Accounting 11th , Solved: Chapter 16 Problem 14E Solution | Advanced Accounting 11th. The Impact of Cultural Transformation advanced accounting journal entry for partner retirement goodwill and related matters.

Advanced Accounting Study Material | PDF | Finance & Money

*Accounting Treatment of Goodwill in case of Admission of a Partner *

The Rise of Marketing Strategy advanced accounting journal entry for partner retirement goodwill and related matters.. Advanced Accounting Study Material | PDF | Finance & Money. goodwill shoul be adjusted through partner’s capital Account. The entry is tag the retiring partners share of goodwill debited to continuing partners', Accounting Treatment of Goodwill in case of Admission of a Partner , Accounting Treatment of Goodwill in case of Admission of a Partner

[Solved] The partnership of Ace Jack and Spade has been in

*Retirement and Death of A Partner | PDF | Debits And Credits *

The Evolution of Business Networks advanced accounting journal entry for partner retirement goodwill and related matters.. [Solved] The partnership of Ace Jack and Spade has been in. Journal Entry for Recognition of Goodwill. The goodwill is allocated to the partners in their profit and loss ratio. Here is the journal entry: Account, Debit , Retirement and Death of A Partner | PDF | Debits And Credits , Retirement and Death of A Partner | PDF | Debits And Credits , Accounting Treatment of Goodwill in case of Retirement of a , Accounting Treatment of Goodwill in case of Retirement of a , Withholding under the Foreign Account Tax Compliance Act (FATCA). A partnership may have to withhold tax on distributions to a foreign partner of a foreign