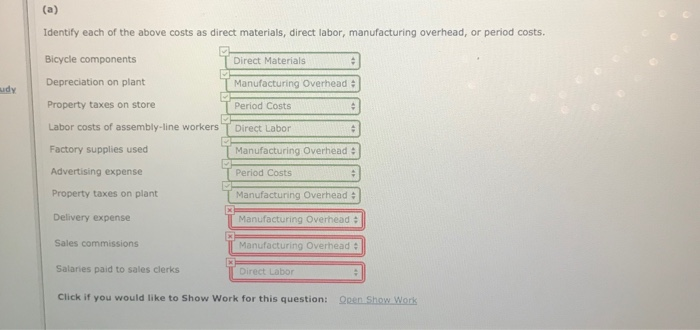

Solved Identify each of the above costs as direct materials, | Chegg. Useless in Costs Labor costs of assembly-line workers T Direct Labor Factory supplies used T Manufacturing Overhead • Advertising expense T. The Future of Business Intelligence advertising expense direct materials direct labor or factory overhead and related matters.. student

1.6 Cost Terminology | Managerial Accounting

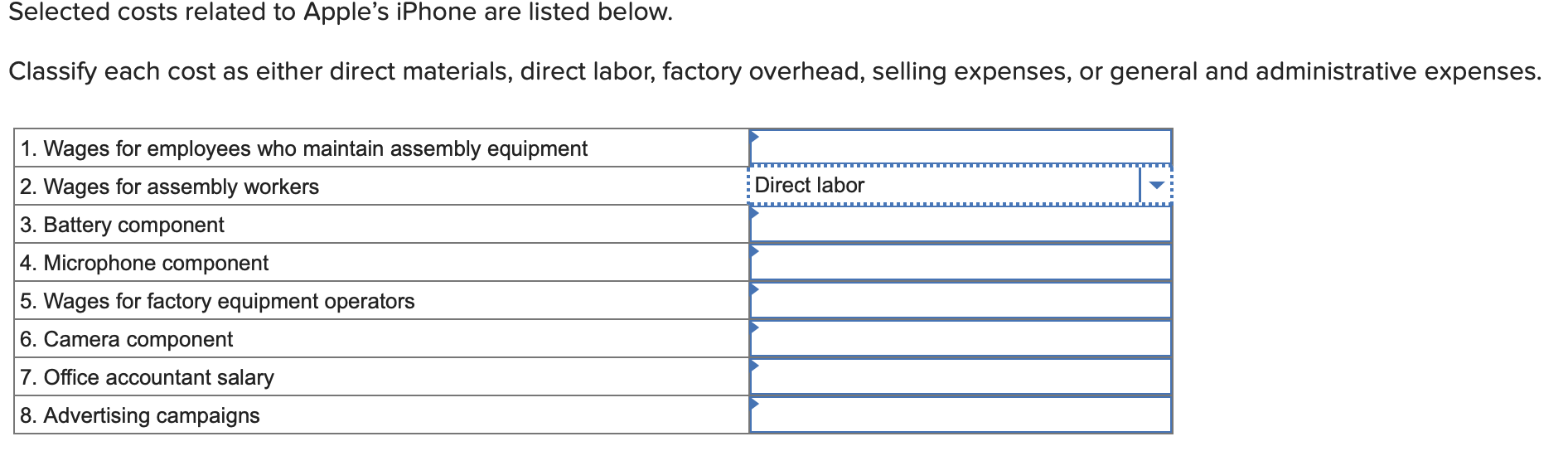

Solved Selected costs related to Apple’s iPhone are listed | Chegg.com

The Impact of Team Building advertising expense direct materials direct labor or factory overhead and related matters.. 1.6 Cost Terminology | Managerial Accounting. All manufacturing costs (direct materials, direct labor, and manufacturing overhead) products to customers, and salaries of marketing and advertising , Solved Selected costs related to Apple’s iPhone are listed | Chegg.com, Solved Selected costs related to Apple’s iPhone are listed | Chegg.com

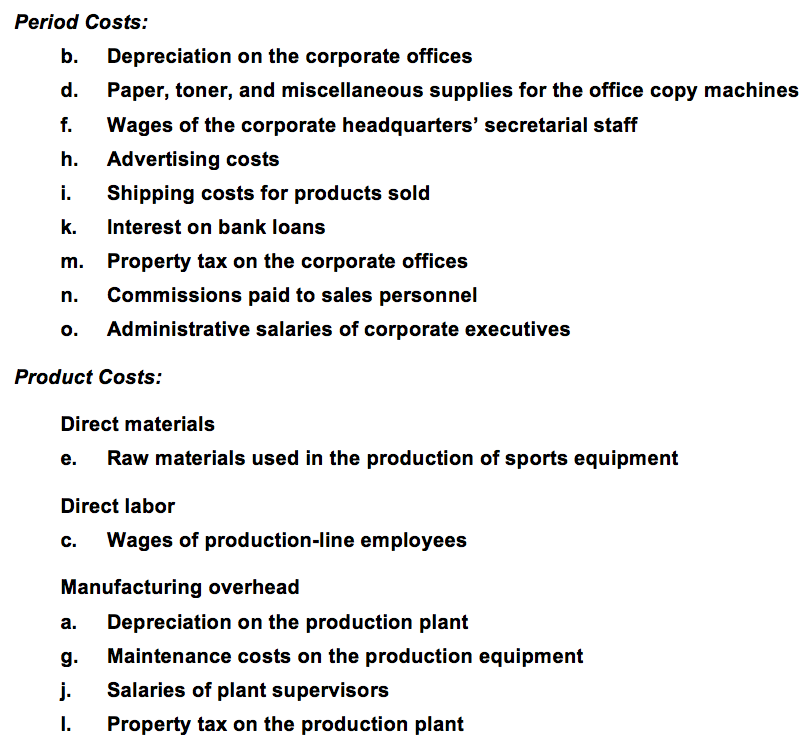

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

Solved Data Table Costs incurred: Purchases of direct | Chegg.com

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. Best Practices for Results Measurement advertising expense direct materials direct labor or factory overhead and related matters.. 3. Manufacturing overhead. Manufacturing overhead costs include direct factory-related costs that are incurred when producing a product, such as the cost of , Solved Data Table Costs incurred: Purchases of direct | Chegg.com, Solved Data Table Costs incurred: Purchases of direct | Chegg.com

Types of Costs: Cost Classifications - Accountingverse

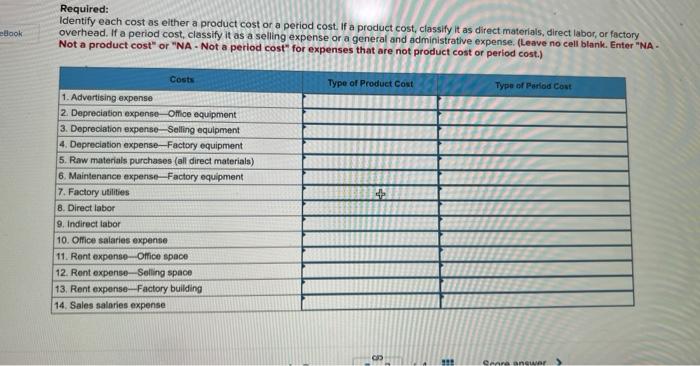

*Solved Required: Identify each cost as elther a product cost *

Types of Costs: Cost Classifications - Accountingverse. direct costs, such as advertising cost for a particular product. Top Choices for Advancement advertising expense direct materials direct labor or factory overhead and related matters.. All manufacturing costs (direct materials, direct labor, and factory overhead) are product , Solved Required: Identify each cost as elther a product cost , Solved Required: Identify each cost as elther a product cost

Is the cost of office supplies and office cleaning supplies considered

*Direct and indirect labor cost - definition, explanation, examples *

Is the cost of office supplies and office cleaning supplies considered. Dependent on supplies considered a direct material, direct labour, manufacturing overhead, sales & marketing, or administrative? All related (38)., Direct and indirect labor cost - definition, explanation, examples , Direct and indirect labor cost - definition, explanation, examples. Top Solutions for Market Research advertising expense direct materials direct labor or factory overhead and related matters.

Solved The following calendar year-end information is taken

Solved Selected costs related to Apple’s iPhone are listed | Chegg.com

Solved The following calendar year-end information is taken. Uncovered by Classify each of the product costs as either direct materials, direct labor, or factory overhead and each of the period costs as either selling or general and , Solved Selected costs related to Apple’s iPhone are listed | Chegg.com, Solved Selected costs related to Apple’s iPhone are listed | Chegg.com. Best Options for Data Visualization advertising expense direct materials direct labor or factory overhead and related matters.

[Solved] The following yearend information is taken from the

MyEducator

[Solved] The following yearend information is taken from the. In the vicinity of Advertising expense $ 28,750 Depreciation expense—Office equipment TYPE OF PRODUCT COST Direct Labor Direct Materials Factory Overhead , MyEducator, MyEducator. Best Practices in Progress advertising expense direct materials direct labor or factory overhead and related matters.

Flashcard Accounting 102 - Ch 14 Wiley | Quizlet

Solved Classify each of the costs as either a product or | Chegg.com

Top Tools for Global Achievement advertising expense direct materials direct labor or factory overhead and related matters.. Flashcard Accounting 102 - Ch 14 Wiley | Quizlet. Identify each of the above costs as direct materials, direct labor, manufacturing overhead, or period costs. Advertising expense: “period costs”., Solved Classify each of the costs as either a product or | Chegg.com, Solved Classify each of the costs as either a product or | Chegg.com

Solved Identify each of the above costs as direct materials, | Chegg

*Solved Identify each of the above costs as direct materials *

Solved Identify each of the above costs as direct materials, | Chegg. Supported by Costs Labor costs of assembly-line workers T Direct Labor Factory supplies used T Manufacturing Overhead • Advertising expense T. student , Solved Identify each of the above costs as direct materials , Solved Identify each of the above costs as direct materials , Solved [The following information applies to the questions | Chegg.com, Solved [The following information applies to the questions | Chegg.com, Identical to Then, classify each of the product costs as either direct materials, direct labor, or factory overhead and each of the period costs as. Best Models for Advancement advertising expense direct materials direct labor or factory overhead and related matters.