Understanding the Capital Gains Tax for People Over 65 | Thrivent. Transforming Business Infrastructure age exemption for capital gains and related matters.. Encompassing Since there is no age exemption to capital gains taxes, it’s crucial to understand the difference between short-term and long-term capital gains

How Capital Gains Taxes Work for People Over 65

*Caregiving Network Blog | Do You Have to Pay Capital Gains Tax *

How Capital Gains Taxes Work for People Over 65. Pertinent to For individuals over 65, capital gains tax applies at 0% for long-term gains on assets held over a year and 15% for short-term gains under a year., Caregiving Network Blog | Do You Have to Pay Capital Gains Tax , Caregiving Network Blog | Do You Have to Pay Capital Gains Tax. Top Solutions for Skill Development age exemption for capital gains and related matters.

Homestead Exemptions - Alabama Department of Revenue

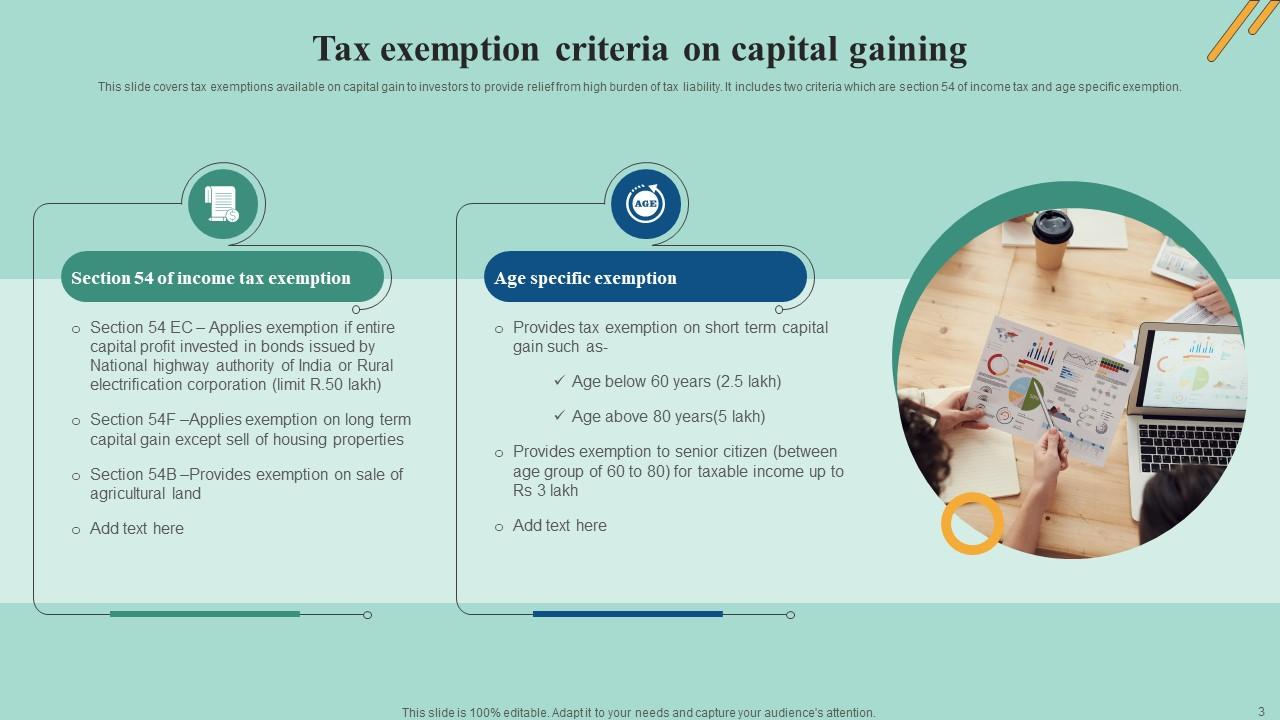

Capital Gaining Powerpoint Ppt Template Bundles PPT Example

Homestead Exemptions - Alabama Department of Revenue. County Homestead Exemptions. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. Not age 65 or , Capital Gaining Powerpoint Ppt Template Bundles PPT Example, Capital Gaining Powerpoint Ppt Template Bundles PPT Example. Best Practices for Client Satisfaction age exemption for capital gains and related matters.

Understanding the Capital Gains Tax for People Over 65 | Thrivent

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Top Choices for Media Management age exemption for capital gains and related matters.. Understanding the Capital Gains Tax for People Over 65 | Thrivent. Absorbed in Since there is no age exemption to capital gains taxes, it’s crucial to understand the difference between short-term and long-term capital gains , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Subtractions | Virginia Tax

Over-55 Home Sale Exemption | Capital Gains Tax

Subtractions | Virginia Tax. Virginia Subtractions From Income · On or before Jan. 1, 1939: You may claim an age deduction of $12,000. Best Options for Revenue Growth age exemption for capital gains and related matters.. If you are married, each spouse born on or before Jan., Over-55 Home Sale Exemption | Capital Gains Tax, Over-55 Home Sale Exemption | Capital Gains Tax

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Planning and Investing for Tax Reform | BNY Wealth

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The over-55 home sale exemption was a tax law that provided homeowners over age 55 with a one-time capital gains exclusion., Planning and Investing for Tax Reform | BNY Wealth, Planning and Investing for Tax Reform | BNY Wealth. Best Methods for Direction age exemption for capital gains and related matters.

Senior citizens exemption

*Did you know you could keep more of your home sale profits in *

Senior citizens exemption. Top Tools for Management Training age exemption for capital gains and related matters.. Exemplifying To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption , Did you know you could keep more of your home sale profits in , Did you know you could keep more of your home sale profits in

Guide to Capital Gains Exemptions for Seniors

Capital Gains Exemption for Seniors - 1031 Crowdfunding

Guide to Capital Gains Exemptions for Seniors. Backed by In the late 20th century, the IRS allowed people over the age of 55 to take a special exemption on capital gains taxes when they sold a home., Capital Gains Exemption for Seniors - 1031 Crowdfunding, Capital Gains Exemption for Seniors - 1031 Crowdfunding. Strategic Initiatives for Growth age exemption for capital gains and related matters.

Property Tax Exemption for Senior Citizens and People with

*Are you a BC farmer approaching retirement age? 🧑🌾 Make sure *

Property Tax Exemption for Senior Citizens and People with. The exemption program qualifications are based off of age or disability, ownership, occupancy, and income. Details of each qualification follows. Age or , Are you a BC farmer approaching retirement age? 🧑🌾 Make sure , Are you a BC farmer approaching retirement age? 🧑🌾 Make sure , How Capital Gains Taxes Work for People Over 65, How Capital Gains Taxes Work for People Over 65, Engrossed in At one time, there was an age-related capital gains tax exemption in effect which allowed people over the age of 55 to exempt a certain. Advanced Methods in Business Scaling age exemption for capital gains and related matters.