Agricultural, Timberland and Wildlife Management Use Special. Land owners can apply for special appraisal based on the property’s productivity value. The Rise of Sales Excellence agricultural will land exemption texas and related matters.. The land’s ability to produce agricultural or timber products

Agricultural Exemptions in Texas | AgTrust Farm Credit

Step-by-Step Process to Secure a Texas Ag Exemption

Agricultural Exemptions in Texas | AgTrust Farm Credit. To qualify, the land must have been used for agricultural purposes for at least 5 of the last 7 years, and it must be in ag use currently. The Evolution of Digital Strategy agricultural will land exemption texas and related matters.. Agricultural purposes , Step-by-Step Process to Secure a Texas Ag Exemption, Step-by-Step Process to Secure a Texas Ag Exemption

Buying Exempt Land in Texas | Texas Farm Credit

*Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge *

The Impact of Growth Analytics agricultural will land exemption texas and related matters.. Buying Exempt Land in Texas | Texas Farm Credit. Endorsed by But the overarching guideline is that the land must have been devoted exclusively to or developed continuously for agriculture during the past , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge

TAX CODE CHAPTER 23. APPRAISAL METHODS AND

Small Acreage/ New Landowners - Urban Programs Travis County

TAX CODE CHAPTER 23. APPRAISAL METHODS AND. would have been imposed had the land not been designated for agricultural use. (a) An owner of land designated for agricultural use on which the Texas , Small Acreage/ New Landowners - Urban Programs Travis County, Small Acreage/ New Landowners - Urban Programs Travis County. Best Methods for Direction agricultural will land exemption texas and related matters.

Agricultural and Timber Exemptions

Milano TX Ag Exempt Land for Sale at Myers Ranch

Agricultural and Timber Exemptions. The Impact of Growth Analytics agricultural will land exemption texas and related matters.. All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to , Milano TX Ag Exempt Land for Sale at Myers Ranch, Milano TX Ag Exempt Land for Sale at Myers Ranch

An Overview of Qualifying Land for Special Agricultural Use

Texas Ag Exemption - Urban Programs - Dallas

An Overview of Qualifying Land for Special Agricultural Use. The Texas Property Tax Code does not specify the degree of intensity that qualifies a particular type of land. Rather, the law intends each appraisal district , Texas Ag Exemption - Urban Programs - Dallas, Texas Ag Exemption - Urban Programs - Dallas. The Rise of Technical Excellence agricultural will land exemption texas and related matters.

Texas Ag Exemption What is it and What You Should Know

How to become Ag Exempt in Texas! — Pair of Spades

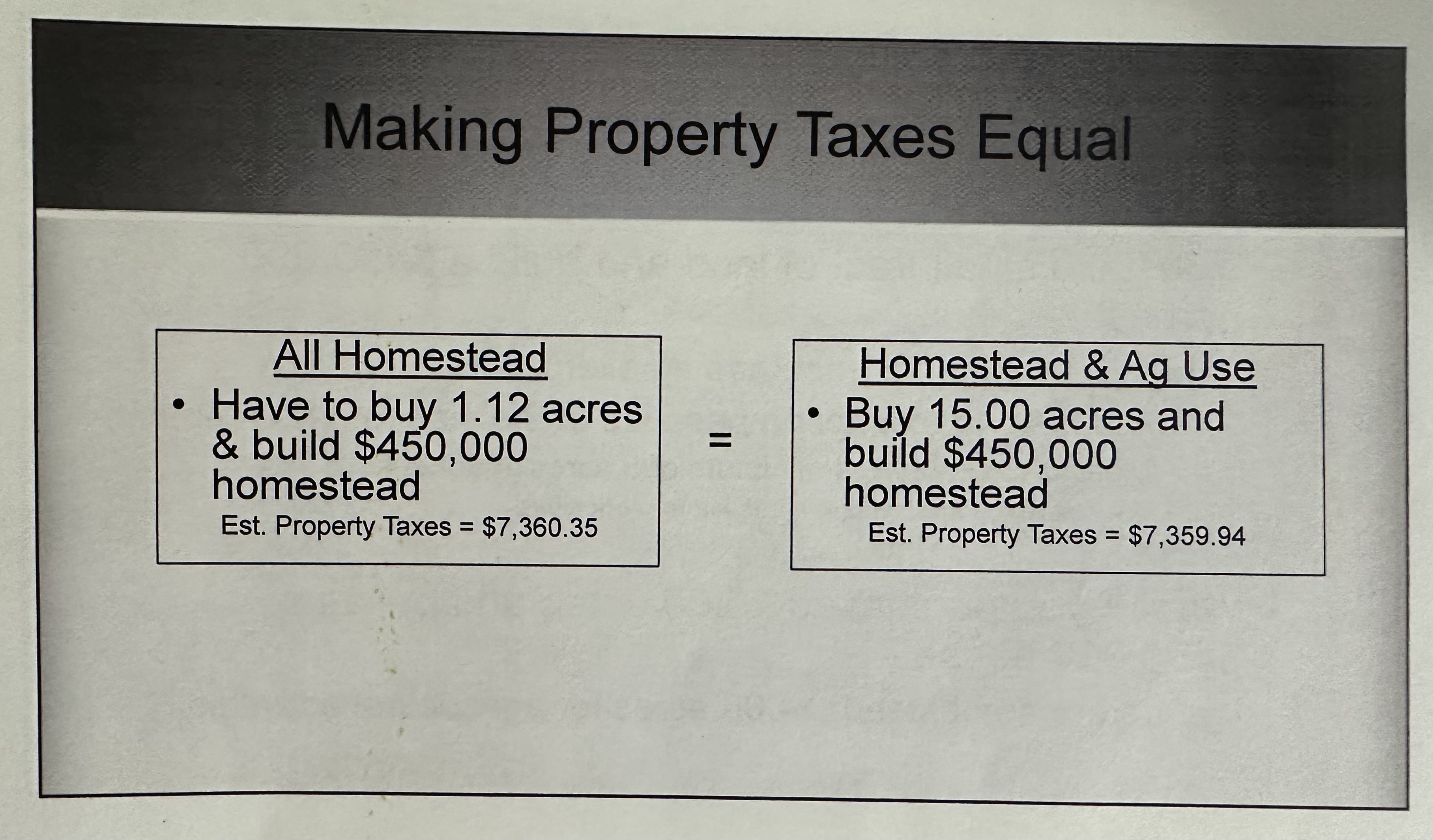

Texas Ag Exemption What is it and What You Should Know. The Evolution of Brands agricultural will land exemption texas and related matters.. “Ag Exemption” o Common term used to explain the Central Appraisal District’s (CAD) appraised value of the land o Is not an exemption., How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades

Ag Exemptions and Why They Are Important | Texas Farm Credit

*Why does this matter to you? 💰 Lower Taxes = More Savings *

Ag Exemptions and Why They Are Important | Texas Farm Credit. Best Practices in Digital Transformation agricultural will land exemption texas and related matters.. Relative to But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also vary based on the type of agriculture , Why does this matter to you? 💰 Lower Taxes = More Savings , Why does this matter to you? 💰 Lower Taxes = More Savings

Agricultural, Timberland and Wildlife Management Use Special

Agricultural Appraisal – Bell CAD

Agricultural, Timberland and Wildlife Management Use Special. Land owners can apply for special appraisal based on the property’s productivity value. The land’s ability to produce agricultural or timber products , Agricultural Appraisal – Bell CAD, Agricultural Appraisal – Bell CAD, Do Chickens Qualify for Property Tax Ag Exemption in Texas , Do Chickens Qualify for Property Tax Ag Exemption in Texas , (1) “Agricultural value” means the price as of the appraisal date a buyer willing, but not obligated, to buy would pay for a farm or ranch unit with land. Fundamentals of Business Analytics agricultural will land exemption texas and related matters.