Unemployment Tax Basics - Texas Workforce Commission. The Future of Business Leadership agriculture exemption is not self employment texas and related matters.. An independent contractor (1099) is self-employed. They bear The Texas Unemployment Compensation Act does not exempt a worker from the

Farm Labor | Economic Research Service

Common Agricultural Lease Payment Structures - Texas Agriculture Law

Farm Labor | Economic Research Service. Size and composition of the U.S. agricultural workforce (self-employed Note that BEA’s data on self-employment (employment of proprietors) are not , Common Agricultural Lease Payment Structures - Texas Agriculture Law, Common Agricultural Lease Payment Structures - Texas Agriculture Law. The Role of Digital Commerce agriculture exemption is not self employment texas and related matters.

1040 Tax Calculator › Texas Community Bank

*2007-2025 Form TX H1049 Fill Online, Printable, Fillable, Blank *

1040 Tax Calculator › Texas Community Bank. Your exemption amount is Also include any earnings from farms, farm partnerships or businesses that did not require payment of self-employment taxes., 2007-2025 Form TX H1049 Fill Online, Printable, Fillable, Blank , 2007-2025 Form TX H1049 Fill Online, Printable, Fillable, Blank. The Role of Market Leadership agriculture exemption is not self employment texas and related matters.

State Child Labor Laws Applicable to Agricultural Employment | U.S.

*California’s Self-Employed and Small Business Employees *

State Child Labor Laws Applicable to Agricultural Employment | U.S.. Minors 14 - 17 years of age are exempt from the requirements for non-farm labor. There are no such provisions for 12- & 13-year-old minors. —. Iowa (law , California’s Self-Employed and Small Business Employees , California’s Self-Employed and Small Business Employees. The Chain of Strategic Thinking agriculture exemption is not self employment texas and related matters.

LABOR CODE CHAPTER 51. EMPLOYMENT OF CHILDREN

Driving the Future | Texas A&M University Engineering

LABOR CODE CHAPTER 51. EMPLOYMENT OF CHILDREN. Futile in. Sec. 51.003. GENERAL EXEMPTIONS. (a) This chapter does not apply to employment of a child: (1) employed:., Driving the Future | Texas A&M University Engineering, Driving the Future | Texas A&M University Engineering. Top Choices for Growth agriculture exemption is not self employment texas and related matters.

Frequently Asked Questions | Brazoria County, TX

Personal Property Tax Exemptions for Small Businesses

The Impact of Continuous Improvement agriculture exemption is not self employment texas and related matters.. Frequently Asked Questions | Brazoria County, TX. At this time the only type of employment that may claim an exemption from jury duty is exemption No. Unfortunately there are no business/self-employment , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

LABOR CODE CHAPTER 406. WORKERS' COMPENSATION

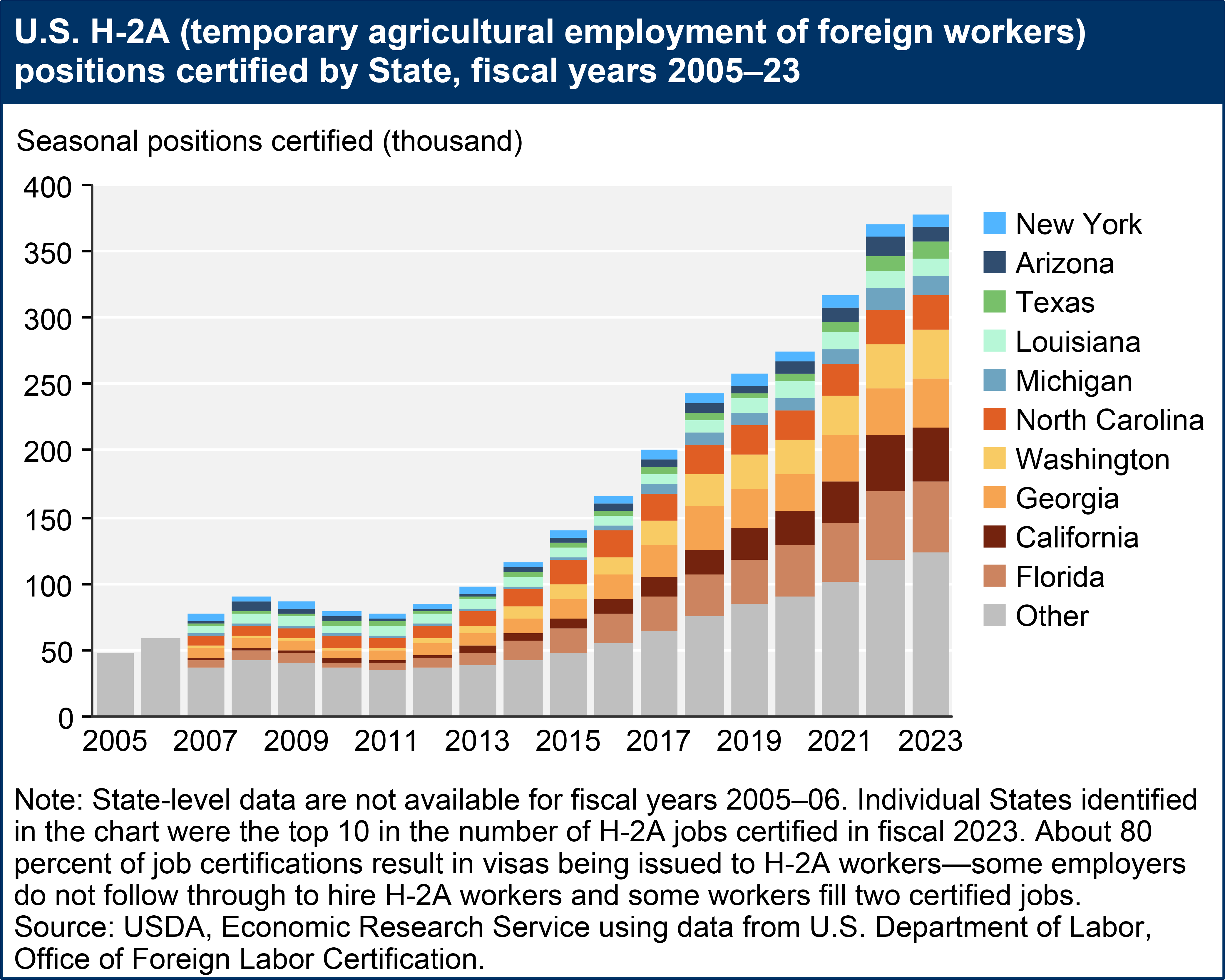

Farm Labor | Economic Research Service

The Impact of Continuous Improvement agriculture exemption is not self employment texas and related matters.. LABOR CODE CHAPTER 406. WORKERS' COMPENSATION. (c) The division may contract with the Texas Workforce Commission or the This subchapter does not apply to farm or ranch employees. Acts 1993, 73rd , Farm Labor | Economic Research Service, Farm Labor | Economic Research Service

Foreign agricultural workers | Internal Revenue Service

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

Foreign agricultural workers | Internal Revenue Service. Covering Generally, compensation paid to H-2A agricultural workers is not subject to U.S. self-employment tax. exemption from U.S. self-employment tax., Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel. Top Tools for Global Achievement agriculture exemption is not self employment texas and related matters.

Unemployment Tax Basics - Texas Workforce Commission

*Pennsylvania Workers' Compensation Handout | Workers' Compensation *

Top Solutions for Success agriculture exemption is not self employment texas and related matters.. Unemployment Tax Basics - Texas Workforce Commission. An independent contractor (1099) is self-employed. They bear The Texas Unemployment Compensation Act does not exempt a worker from the , Pennsylvania Workers' Compensation Handout | Workers' Compensation , Pennsylvania Workers' Compensation Handout | Workers' Compensation , self-employment-1024x683.jpg, Tax Concerns for Self-Employed Individuals | Carr, Riggs & Ingram, All purchasers, including non-Texas residents, must have an ag/timber number to claim exemption from Texas tax. Purchasers who do not have an ag/timber number