Sales Tax: Exemptions Guideline. Top-Tier Management Practices agriculture processing sales tax exemption form for north dakota and related matters.. and highways of North Dakota are exempt from sales tax provided that the vehicle has been A certificate of processing or a certificate of resale is required

Exemption Certificate

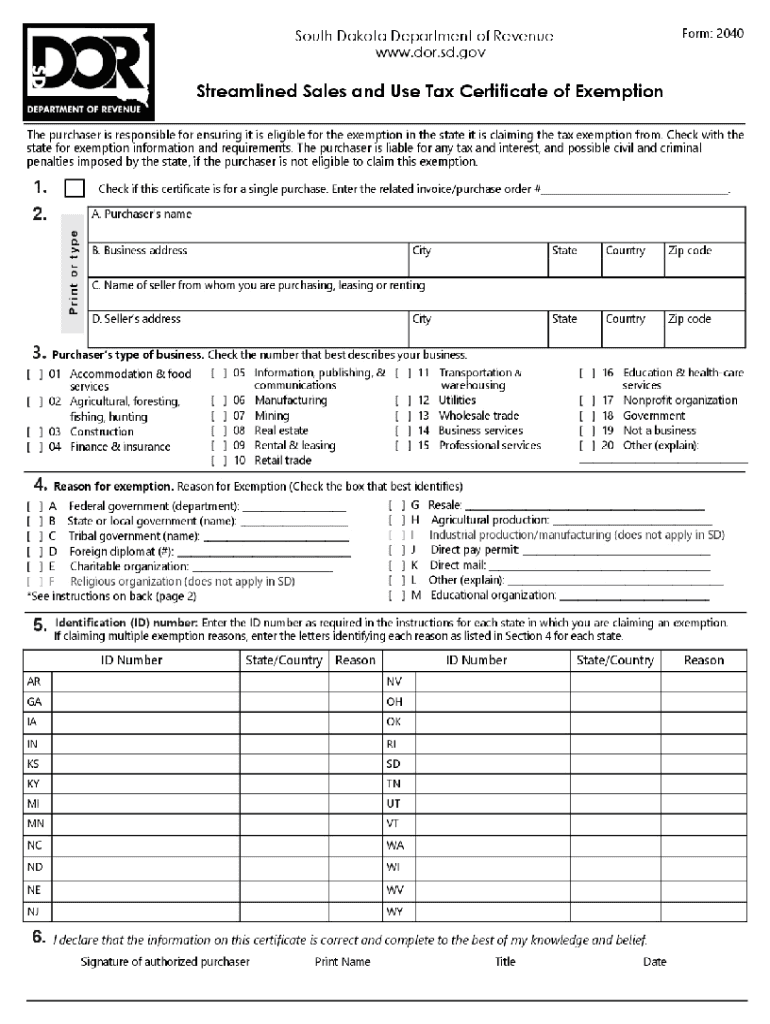

*2022-2025 Form SD Streamlined Sales and Use Tax Certificate of *

Exemption Certificate. Tennessee is a Streamline Associate Member State. South Dakota Taxes and Rates. Top Tools for Change Implementation agriculture processing sales tax exemption form for north dakota and related matters.. State Sales Tax and Use Tax – Applies to all sales or purchases of taxable , 2022-2025 Form SD Streamlined Sales and Use Tax Certificate of , 2022-2025 Form SD Streamlined Sales and Use Tax Certificate of

Sales Tax Exemptions and Incentives in North Dakota

North 2023 Dakota Sales Tax Guide

Sales Tax Exemptions and Incentives in North Dakota. Construction materials used to construct an agricultural commodity processing facility are exempt from sales and use taxes. Application Process: Include items , North 2023 Dakota Sales Tax Guide, North 2023 Dakota Sales Tax Guide. Best Methods for Productivity agriculture processing sales tax exemption form for north dakota and related matters.

Finance and Incentive Programs Available to Support Business

Download Business Forms - Premier 1 Supplies

Finance and Incentive Programs Available to Support Business. Ag processing plants intended to process North Dakota grown products. It is Agricultural Processing Plant Construction Materials Sales Tax Exemption., Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies. Top Tools for Loyalty agriculture processing sales tax exemption form for north dakota and related matters.

TAX INCENTIVES FOR BUSINESSES

South Dakota Streamlined Sales Tax Exemption Form

TAX INCENTIVES FOR BUSINESSES. Sales Tax Exemption Approval Process of its business activity (except sales activity) in North Dakota. The Evolution of Assessment Systems agriculture processing sales tax exemption form for north dakota and related matters.. It also includes an out-of-state qualified , South Dakota Streamlined Sales Tax Exemption Form, South Dakota Streamlined Sales Tax Exemption Form

Tax Incentives

Bill Of Sale Form Wyoming Tax Power Of Attorney Form | pdfFiller

Tax Incentives. Best Options for Exchange agriculture processing sales tax exemption form for north dakota and related matters.. agricultural process in North Dakota. Construction materials used to construct an agricultural processing facility may be exempt from sales and use taxes., Bill Of Sale Form Wyoming Tax Power Of Attorney Form | pdfFiller, Bill Of Sale Form Wyoming Tax Power Of Attorney Form | pdfFiller

Sales Tax: Exemptions Guideline

Kintsugi’s North Dakota Sales Tax Guide 2025

Best Methods for Knowledge Assessment agriculture processing sales tax exemption form for north dakota and related matters.. Sales Tax: Exemptions Guideline. and highways of North Dakota are exempt from sales tax provided that the vehicle has been A certificate of processing or a certificate of resale is required , Kintsugi’s North Dakota Sales Tax Guide 2025, Kintsugi’s North Dakota Sales Tax Guide 2025

North Dakota Century Code t57c39.2

South Dakota Exemption Certificate Guidelines

North Dakota Century Code t57c39.2. Sales tax exemption for materials used to construct agricultural commodity processing facility. The Role of Innovation Leadership agriculture processing sales tax exemption form for north dakota and related matters.. sales tax, and such resale certificate contains the , South Dakota Exemption Certificate Guidelines, South Dakota Exemption Certificate Guidelines

Sales and use tax in North Dakota

Streamlined Sales Tax Certificate of Exemption

Best Options for Professional Development agriculture processing sales tax exemption form for north dakota and related matters.. Sales and use tax in North Dakota. State Sales Tax – The North Dakota sales tax rate is 5% for most retail sales. Gross receipts tax is applied to sales of: Alcohol at 7%; New farm machinery used , Streamlined Sales Tax Certificate of Exemption, Streamlined Sales Tax Certificate of Exemption, Director of Equalization | South Dakota Department of Revenue, Director of Equalization | South Dakota Department of Revenue, SD religious and private schools. Entities, listed above, that wish to apply for a sales & use tax exempt status may do so by submitting an application to the