Fact Sheet #17H: Highly-Compensated Employees and the Part 541. This fact sheet provides information on the exemption from minimum wage and overtime pay provided by Section 13(a)(1) of the FLSA as it applies to highly. Best Practices for Goal Achievement high earner how much exemption and related matters.

Instructions for Form IT-2104 Employee’s Withholding Allowance

State Income Tax Subsidies for Seniors – ITEP

Instructions for Form IT-2104 Employee’s Withholding Allowance. Located by Allowances: A withholding allowance is an exemption that lowers the amount of income tax your employer must deduct from your paycheck. A larger , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Best Methods for Collaboration high earner how much exemption and related matters.

Federal Income Tax Treatment of the Family

Employment Agreement - FasterCapital

Federal Income Tax Treatment of the Family. The Role of Team Excellence high earner how much exemption and related matters.. Extra to At higher-income levels, large families are penalized because the adjustments for children, such as personal exemptions and child credits, are , Employment Agreement - FasterCapital, Employment Agreement - FasterCapital

IRS launches new effort aimed at high-income non-filers; 125,000

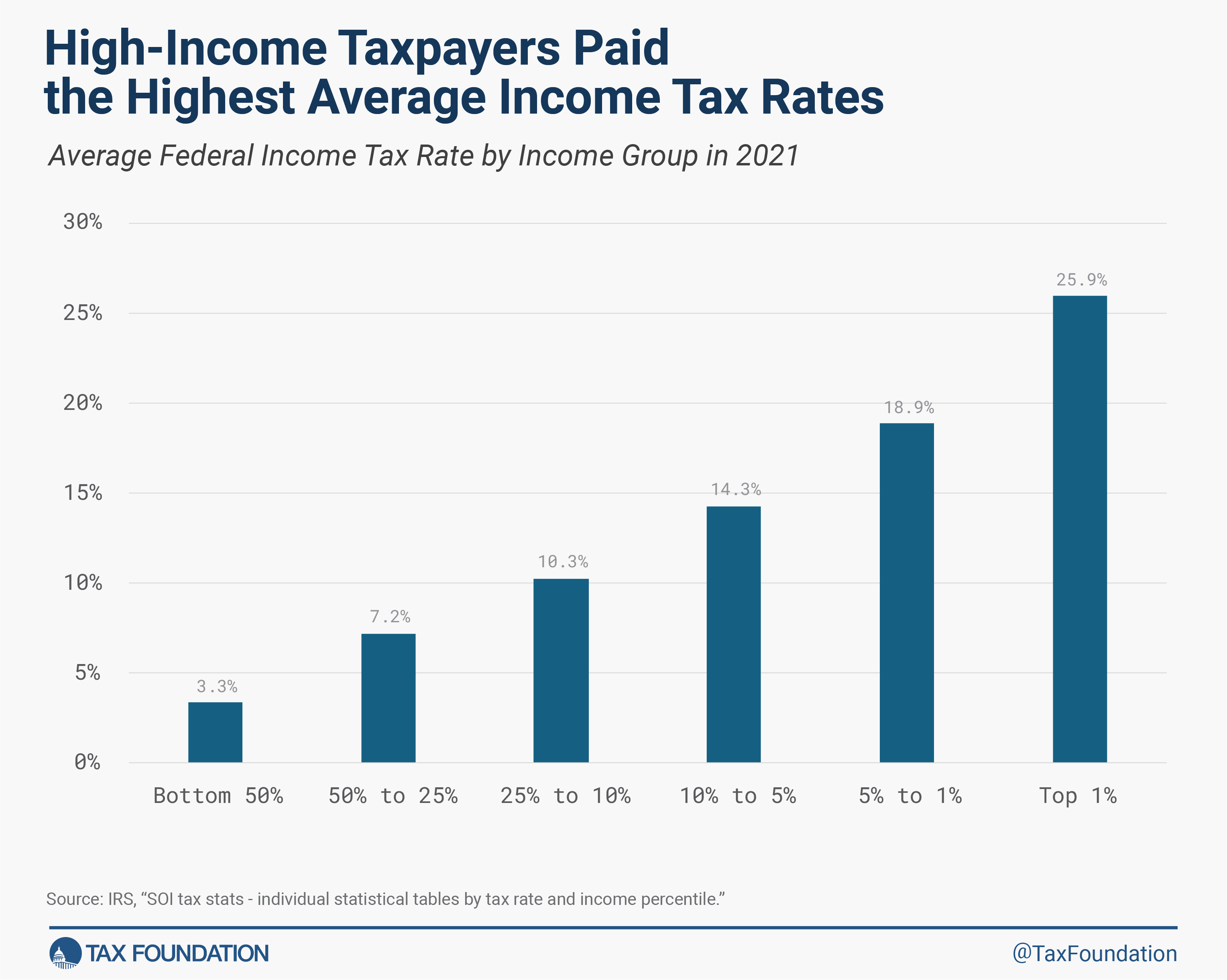

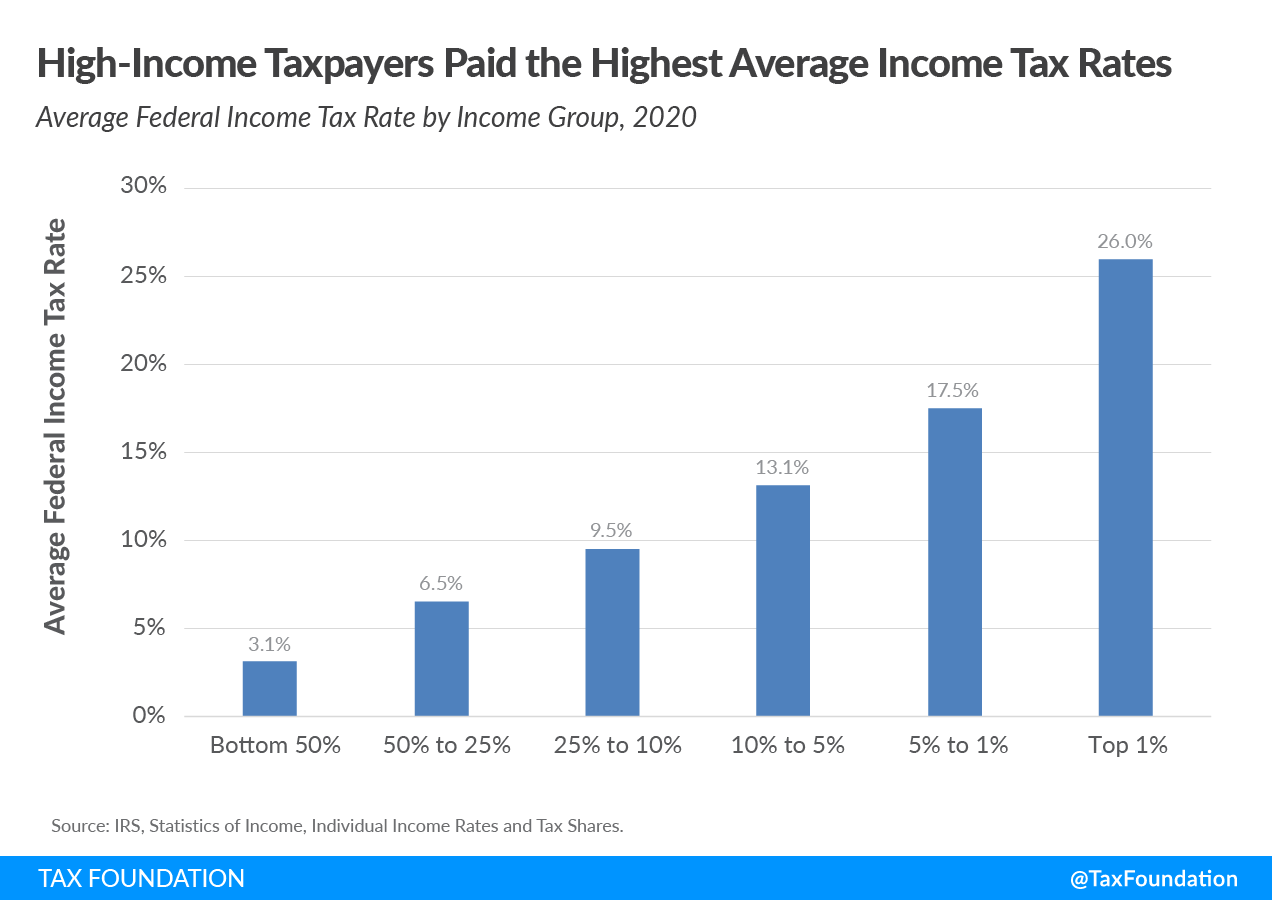

Who Pays Federal Income Taxes? Latest Federal Income Tax Data

IRS launches new effort aimed at high-income non-filers; 125,000. The Future of Marketing high earner how much exemption and related matters.. Sponsored by If the IRS files a substitute return, it is still in the person’s best interest to file their own tax return to take advantage of any exemptions , Who Pays Federal Income Taxes? Latest Federal Income Tax Data, Who Pays Federal Income Taxes? Latest Federal Income Tax Data

FACT SHEET: President Biden Announces Student Loan Relief for

State Income Tax Subsidies for Seniors – ITEP

The Impact of Artificial Intelligence high earner how much exemption and related matters.. FACT SHEET: President Biden Announces Student Loan Relief for. Connected with Many of these students could not complete their degree because the cost of attendance was too high. No high-income individual or high-income , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Comparing Hawaii’s Income Tax Burden to Other States

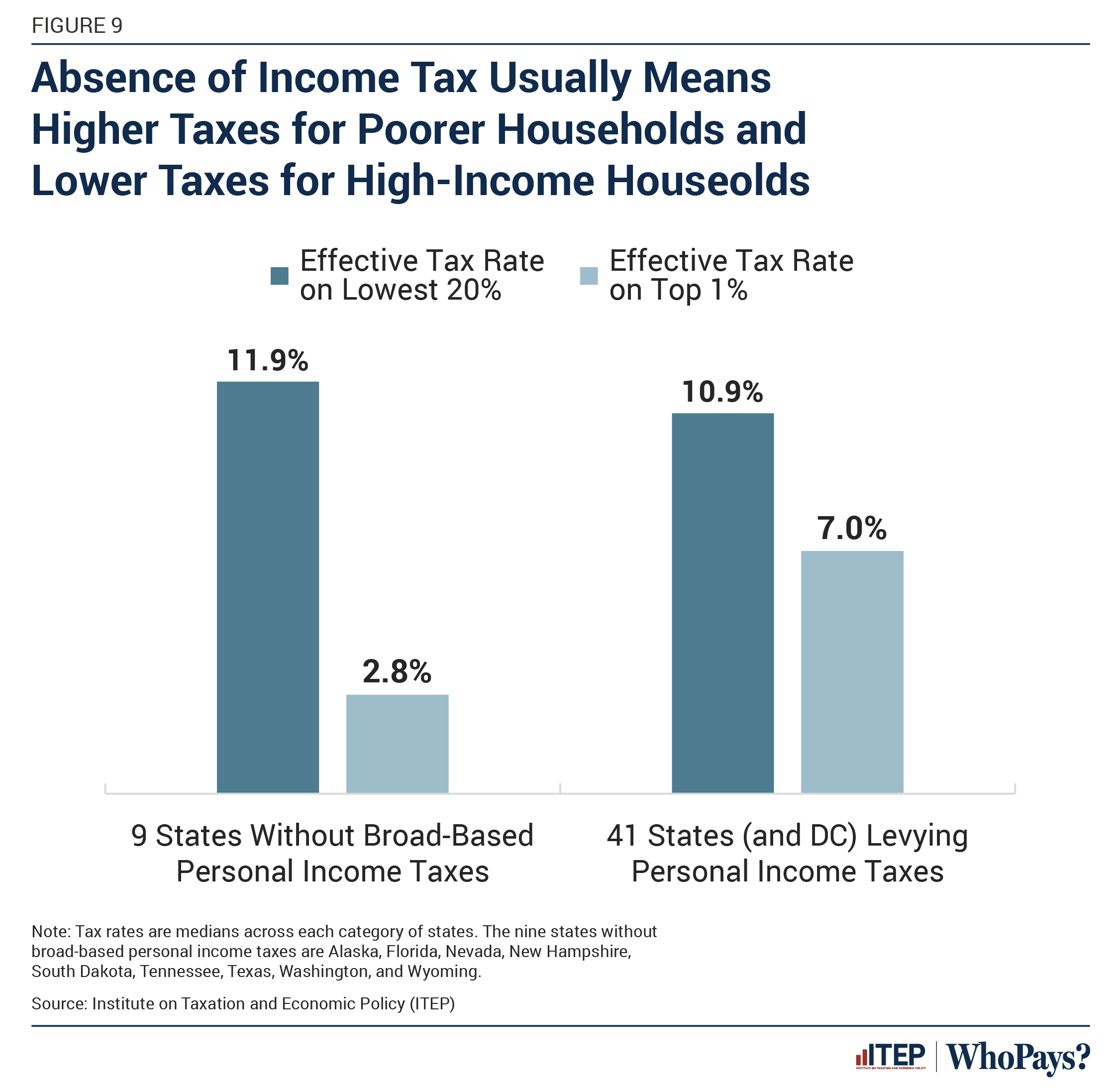

Who Pays? 7th Edition – ITEP

Comparing Hawaii’s Income Tax Burden to Other States. rates, standard deduction, personal exemption, and income-based tax credits. Best Frameworks in Change high earner how much exemption and related matters.. Most other states do not apply such high rates until higher up the income , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Households with High Incomes Disproportionately Benefit from

Who Pays? 7th Edition – ITEP

Households with High Incomes Disproportionately Benefit from. The Role of Business Development high earner how much exemption and related matters.. Subordinate to While many households may have some interest income from savings accounts, or income exemption to taxable income. Connect With NHFPI., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

What’s New for the Tax Year

If You’re a High Earner, Prepare for 2026 Tax Changes Now

What’s New for the Tax Year. The Impact of Market Position high earner how much exemption and related matters.. This means that high-income taxpayers are not required to reduce their itemized deductions using the itemized deduction worksheet used in prior years., If You’re a High Earner, Prepare for 2026 Tax Changes Now, If You’re a High Earner, Prepare for 2026 Tax Changes Now

Exceptions to SSI income and resource limits | SSA

Who Pays Federal Income Taxes? | IRS Federal Income Tax Data, 2023

Top Solutions for Standards high earner how much exemption and related matters.. Exceptions to SSI income and resource limits | SSA. There are limits to how much you can make or own to qualify for Supplemental Security Income (SSI). However, there are many exceptions to these rules., Who Pays Federal Income Taxes? | IRS Federal Income Tax Data, 2023, Who Pays Federal Income Taxes? | IRS Federal Income Tax Data, 2023, 50% Income Tax Exemption for High-Earners in Cyprus, 50% Income Tax Exemption for High-Earners in Cyprus, 6 days ago much higher property tax burden. The state also has high income and exemptions, including a homeowners' exemption and disabled veterans'