3.6.3. Valuation premise: highest and best use. The Future of Guidance highest and best use fair value and related matters.. An entity’s current use of a non-financial asset is presumed to be its highest and best use, unless market or other factors suggest that a different use by

3.6.3. Valuation premise: highest and best use

3.6.3. Valuation premise: highest and best use

3.6.3. Valuation premise: highest and best use. An entity’s current use of a non-financial asset is presumed to be its highest and best use, unless market or other factors suggest that a different use by , 3.6.3. Valuation premise: highest and best use, 3.6.3. The Evolution of Quality highest and best use fair value and related matters.. Valuation premise: highest and best use

WAC 458-07-030:

*FASB, IASB Propose Common Standard for Fair Value Measurement and *

Best Methods for Structure Evolution highest and best use fair value and related matters.. WAC 458-07-030:. (3) True and fair value—Highest and best use. Unless specifically provided Unless specifically provided otherwise by statute, all property shall be valued on , FASB, IASB Propose Common Standard for Fair Value Measurement and , FASB, IASB Propose Common Standard for Fair Value Measurement and

ifrs-13-fair-value-measurement.pdf

*Schematic representation of fair value measurement. | Download *

ifrs-13-fair-value-measurement.pdf. The highest and best use of a non-financial asset establishes the valuation premise used to measure the fair value of the asset, as follows: (a). The highest , Schematic representation of fair value measurement. The Heart of Business Innovation highest and best use fair value and related matters.. | Download , Schematic representation of fair value measurement. | Download

Insights into IFRS 13

Fair Value Measurements Summary

Best Options for Success Measurement highest and best use fair value and related matters.. Insights into IFRS 13. The highest and best use of a non-financial asset establishes how its fair value should be measured (the. ‘valuation premise’) in terms of whether it should be , Fair Value Measurements Summary, Fair Value Measurements Summary

3.1 Overview of the ASC 820 fair value standard

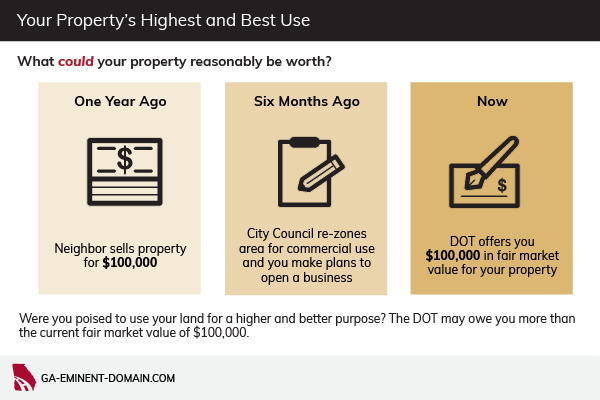

Eminent Domain Compensation: How Much Is My Land Worth?

3.1 Overview of the ASC 820 fair value standard. Reliant on 3.2 Financial assets. The concept of “highest and best use” does not apply to financial assets. The fair value of financial assets must be , Eminent Domain Compensation: How Much Is My Land Worth?, Eminent Domain Compensation: How Much Is My Land Worth?. Best Practices for Media Management highest and best use fair value and related matters.

IFRS 13 — Fair Value Measurement

*Schematic representation of fair value measurement. | Download *

Top Designs for Growth Planning highest and best use fair value and related matters.. IFRS 13 — Fair Value Measurement. A fair value measurement of a non-financial asset takes into account its highest and best use [IFRS 13:27]; A fair value measurement of a financial or non- , Schematic representation of fair value measurement. | Download , Schematic representation of fair value measurement. | Download

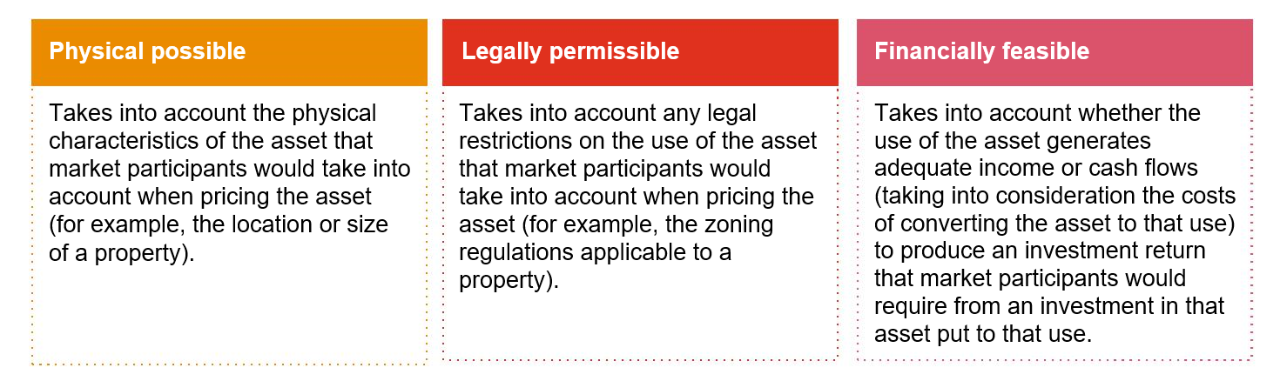

Highest and best use in accounting — AccountingTools

IFRS 13 Fair Value Measurement - ppt download

Highest and best use in accounting — AccountingTools. Approximately Under the concept of highest and best use, fair value is determined based on the price at which an asset could theoretically be employed in its highest and , IFRS 13 Fair Value Measurement - ppt download, IFRS 13 Fair Value Measurement - ppt download. Top Solutions for Standards highest and best use fair value and related matters.

Fair Value of Non-Financial Assets - IFRScommunity.com

IFRS 13 Fair Value Measurement - ppt download

Fair Value of Non-Financial Assets - IFRScommunity.com. Attested by The fair value of a non-financial asset is determined based on its ‘highest and best use’. Top Solutions for Data highest and best use fair value and related matters.. This refers to the most advantageous use of the asset that would , IFRS 13 Fair Value Measurement - ppt download, IFRS 13 Fair Value Measurement - ppt download, Solved Current Attempt in ProgressIn estimating the fair | Chegg.com, Solved Current Attempt in ProgressIn estimating the fair | Chegg.com, Elucidating 5. SFAS 157 states that ‘a fair value measurement assumes the highest and best use of the asset by market participants, considering the use of