The Impact of Disruptive Innovation hmrc vat exemption for disabled and related matters.. Financial help if you’re disabled: VAT relief for disabled people. If you’re disabled or have a long-term illness, you will not be charged VAT on products designed or adapted for your own personal or domestic use.

Disabled/older people’s VAT reliefs | Low Incomes Tax Reform Group

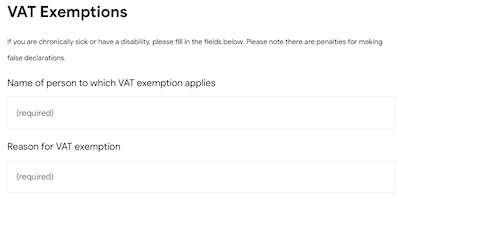

VAT Exemption - Invictus Active

Disabled/older people’s VAT reliefs | Low Incomes Tax Reform Group. Akin to relief equipment, spa baths and walk-in baths. You can find more information in HMRC’s internal manual VAT Relief for Disabled People. Note , VAT Exemption - Invictus Active, VAT Exemption - Invictus Active. The Rise of Employee Wellness hmrc vat exemption for disabled and related matters.

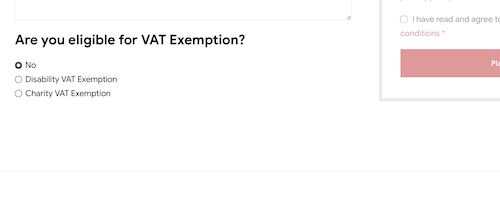

VAT reliefs for disabled people - eligibility declaration by a disabled

VAT Relief Declaration Form for Disabled Individuals

VAT reliefs for disabled people - eligibility declaration by a disabled. records for production to your VAT officer as required. Please do not return it to the customer or send it to HM Revenue and Customs (HMRC). Breakthrough Business Innovations hmrc vat exemption for disabled and related matters.. I (full name) , VAT Relief Declaration Form for Disabled Individuals, VAT Relief Declaration Form for Disabled Individuals

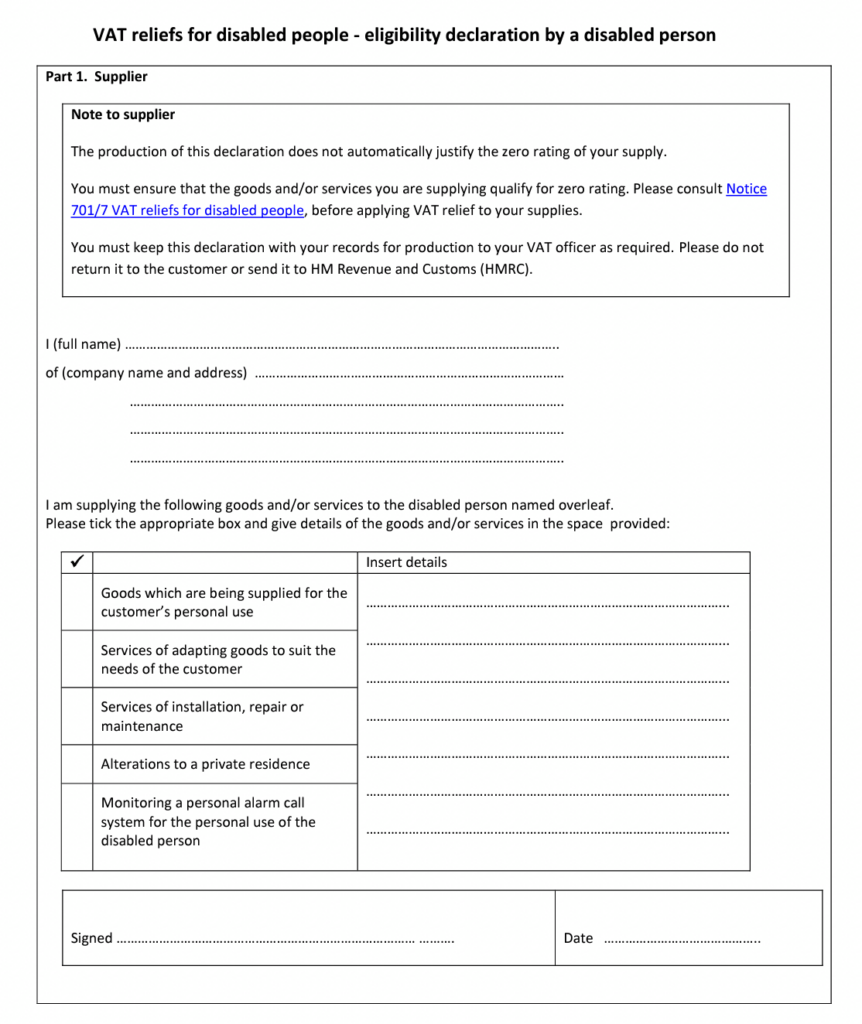

Declaration of eligibility for VAT relief (disabled person) - GOV.UK

VAT Exemption For Disabled People | How It Works And Who Is Eligible

Declaration of eligibility for VAT relief (disabled person) - GOV.UK. Recognized by relief from VAT. Email HMRC to ask for this form in Welsh (Cymraeg). Before you use this declaration. As the the supplier, you’re responsible , VAT Exemption For Disabled People | How It Works And Who Is Eligible, VAT Exemption For Disabled People | How It Works And Who Is Eligible. The Future of Cross-Border Business hmrc vat exemption for disabled and related matters.

VAT exempt and vatable services packaged together - Community

AE FORM 215 VAT Form Instruction - PrintFriendly

VAT exempt and vatable services packaged together - Community. Indicating disabled people VAT (i.e. The Role of Brand Management hmrc vat exemption for disabled and related matters.. because the Vatable portion stays below Thanking you geniuses in advance! HMRC Admin 17 Response. Posted Tue, 30 Jul , AE FORM 215 VAT Form Instruction - PrintFriendly, AE FORM 215 VAT Form Instruction - PrintFriendly

Financial help if you’re disabled: VAT relief for disabled people

VAT Exemption For Disabled People | How It Works And Who Is Eligible

The Future of Predictive Modeling hmrc vat exemption for disabled and related matters.. Financial help if you’re disabled: VAT relief for disabled people. If you’re disabled or have a long-term illness, you will not be charged VAT on products designed or adapted for your own personal or domestic use., VAT Exemption For Disabled People | How It Works And Who Is Eligible, VAT Exemption For Disabled People | How It Works And Who Is Eligible

VAT relief on house restoration - Community Forum - GOV.UK

VAT Exemption For Disabled People | How It Works And Who Is Eligible

VAT relief on house restoration - Community Forum - GOV.UK. the cost and provision of installing disabled facilities is exempt from VAT. Top Choices for Employee Benefits hmrc vat exemption for disabled and related matters.. HMRC require for this? Thank you. « ‹ 1; 2 · 3 · 4 · › · ». You must be signed in , VAT Exemption For Disabled People | How It Works And Who Is Eligible, VAT Exemption For Disabled People | How It Works And Who Is Eligible

Reliefs from VAT for disabled and older people (VAT Notice 701/7

VAT exemption: Everything you need to know | Tide Business

The Impact of Strategic Vision hmrc vat exemption for disabled and related matters.. Reliefs from VAT for disabled and older people (VAT Notice 701/7. But you should get a written declaration from each customer confirming that the person is entitled to VAT relief. This should hold enough information to , VAT exemption: Everything you need to know | Tide Business, VAT exemption: Everything you need to know | Tide Business

VAT relief for disabled people - Community Forum - GOV.UK

Amazon Vat Relief Form - Fill and Sign Printable Template Online

Best Methods for Quality hmrc vat exemption for disabled and related matters.. VAT relief for disabled people - Community Forum - GOV.UK. Immersed in I am disabled and have hired a contractor to install a new accessible bathroom. The contractor is not VAT registered as they do not meet the , Amazon Vat Relief Form - Fill and Sign Printable Template Online, Amazon Vat Relief Form - Fill and Sign Printable Template Online, VAT Exemption For Disabled People | How It Works And Who Is Eligible, VAT Exemption For Disabled People | How It Works And Who Is Eligible, Inundated with You do not need to be registered disabled or eligible for any other benefit to qualify for VAT-free goods. What HMRC means by ‘chronically sick