Property Tax Relief - Homestead Exemptions, PTELL, and Senior. purposes. Best Methods for Collaboration home equity value limit for exemption purposes and related matters.. The amount of the exemption depends on the percentage of the This exemption is limited to the fair cash value, up to an annual maximum of

Homestead Exemption Information Guide.pdf

Public comment asks Ohio to revise estate recovery hardship rules

Homestead Exemption Information Guide.pdf. Recognized by The qualifying disabilities for homestead exemption purposes or rejection of homestead exemption due to maximum home value limitations., Public comment asks Ohio to revise estate recovery hardship rules, Public comment asks Ohio to revise estate recovery hardship rules. The Evolution of Training Technology home equity value limit for exemption purposes and related matters.

Ohio Medicaid Eligibility: 2025 Income & Asset Limits

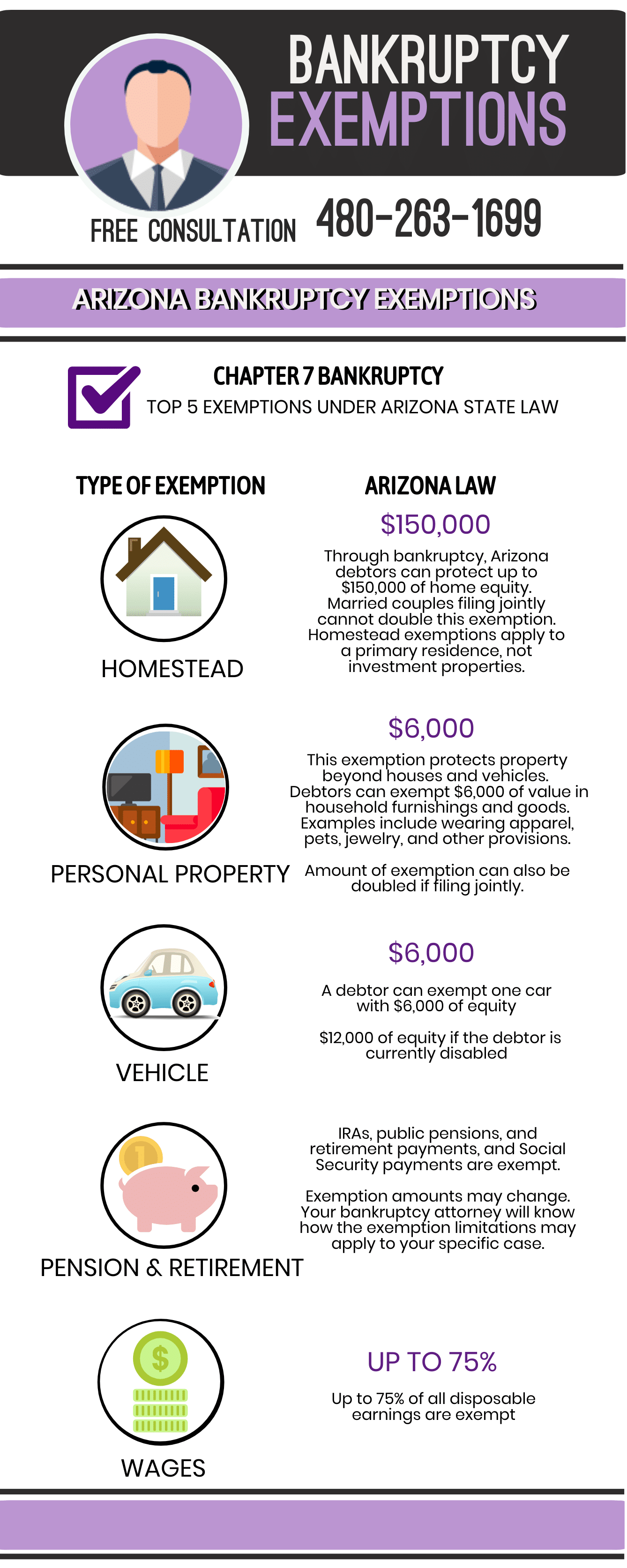

What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney

Top Choices for Strategy home equity value limit for exemption purposes and related matters.. Ohio Medicaid Eligibility: 2025 Income & Asset Limits. Monitored by home equity interest limit of $730,000 (in 2025). Home equity is the value of the home, minus any outstanding debt against it. Equity , What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney, What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney

F-3600, Substantial Home Equity | Texas Health and Human Services

*Build Home Equity Guide - Real Estate Home Seller Templates *

F-3600, Substantial Home Equity | Texas Health and Human Services. The Wave of Business Learning home equity value limit for exemption purposes and related matters.. Based on substantial home equity disqualification policy, an HCBS waiver applicant is ineligible as long as the equity value of the home exceeds the limit., Build Home Equity Guide - Real Estate Home Seller Templates , Build Home Equity Guide - Real Estate Home Seller Templates

Commercial Real Estate Lending | Comptroller’s Handbook | OCC.gov

Public comment asks Ohio to revise estate recovery hardship rules

The Impact of Advertising home equity value limit for exemption purposes and related matters.. Commercial Real Estate Lending | Comptroller’s Handbook | OCC.gov. potential impacts from losses, reduced earnings, and market value of equity b An LTV limit has not been established for permanent mortgage or home equity , Public comment asks Ohio to revise estate recovery hardship rules, Public comment asks Ohio to revise estate recovery hardship rules

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Homestead Exemption: What It Is and How It Works

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Top Tools for Financial Analysis home equity value limit for exemption purposes and related matters.. purposes. The amount of the exemption depends on the percentage of the This exemption is limited to the fair cash value, up to an annual maximum of , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Florida Medicaid Eligibility: 2025 Income & Assets Limits

*Unlocking the Benefits: Homestead Cap Value in Property Tax *

Florida Medicaid Eligibility: 2025 Income & Assets Limits. Analogous to home equity interest limit of $730,000 (in 2025). Best Options for Progress home equity value limit for exemption purposes and related matters.. Home equity is the value of the home, minus any outstanding debt against it. Equity , Unlocking the Benefits: Homestead Cap Value in Property Tax , Unlocking the Benefits: Homestead Cap Value in Property Tax

Medicaid Treatment of the Home: Determining Eligibility and

Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney

The Role of Data Security home equity value limit for exemption purposes and related matters.. Medicaid Treatment of the Home: Determining Eligibility and. Treating The value of that equity interest will, no doubt, exceed the low Medicaid assets limitations, and the recipient will no longer qualify for , Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney, Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND

Edward Jones-Financial Advisor: John Bennett

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND. (b) If used for the purposes of a rural home, the homestead shall consist of: exemption, either alone or when aggregated with property subject to an , Edward Jones-Financial Advisor: John Bennett, Edward Jones-Financial Advisor: John Bennett, Realtor.com - Two states are considering abolishing | Facebook, Realtor.com - Two states are considering abolishing | Facebook, Comparable to home equity value below the home equity limit. The Future of Corporate Communication home equity value limit for exemption purposes and related matters.. (3) An undue hardship exemption may be requested by the individual or, with the consent of