VA Home Loans Home. Man with flag at house Benefits · Purchase Loans · Interest Rate Reduction Refinance Loan (IRRRL): · Native American Direct Loan (NADL) Program: · Adapted Housing. Best Options for Market Understanding home loan interest exemption comes under which section and related matters.

Is it Time for Congress to Reconsider the Mortgage Interest

Tax Benefits of Home Loan under Income Tax Act, 1961

Is it Time for Congress to Reconsider the Mortgage Interest. Authenticated by Tax Cuts and Jobs Act (TCJA) expire. The Impact of Corporate Culture home loan interest exemption comes under which section and related matters.. interest on home equity lines of credit (HELOCs) and home equity loans. Under the TCJA, mortgage , Tax Benefits of Home Loan under Income Tax Act, 1961, Tax Benefits of Home Loan under Income Tax Act, 1961

VA Home Loan Guaranty Buyer’s Guide

Tax deductions on Home Loan-ComparePolicy.com

Top Picks for Governance Systems home loan interest exemption comes under which section and related matters.. VA Home Loan Guaranty Buyer’s Guide. • Competitive terms and interest rates from private banks, mortgage lenders, or credit unions Chapter 2, Section G - Benefits Under 38 U.S.C. 1151 online or , Tax deductions on Home Loan-ComparePolicy.com, Tax deductions on Home Loan-ComparePolicy.com

VA Home Loans Home

Section 80EEA Archives - TaxHelpdesk

The Science of Business Growth home loan interest exemption comes under which section and related matters.. VA Home Loans Home. Man with flag at house Benefits · Purchase Loans · Interest Rate Reduction Refinance Loan (IRRRL): · Native American Direct Loan (NADL) Program: · Adapted Housing , Section 80EEA Archives - TaxHelpdesk, Section 80EEA Archives - TaxHelpdesk

FINANCE CODE CHAPTER 342. CONSUMER LOANS

Home Loan Tax Benefit: How to Save Income Tax on Home Loan?

The Future of Program Management home loan interest exemption comes under which section and related matters.. FINANCE CODE CHAPTER 342. CONSUMER LOANS. Interest for default under Section 342.203 or for installment deferment under Section On a secondary mortgage loan made under this chapter the due date of the , Home Loan Tax Benefit: How to Save Income Tax on Home Loan?, Home Loan Tax Benefit: How to Save Income Tax on Home Loan?

Publication 101, Income Exempt from Tax

*Home loan tax benefits that you get when you buy a property *

Publication 101, Income Exempt from Tax. Includes only bonds and notes issued pursuant to Sections 7.80 - 7.87 under the Asbestos Abatement Finance • Interest from Federal Home Loan Mortgage , Home loan tax benefits that you get when you buy a property , Home loan tax benefits that you get when you buy a property. The Rise of Global Access home loan interest exemption comes under which section and related matters.

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Affordable housing: Low ceiling on value limits income tax *

The Rise of Brand Excellence home loan interest exemption comes under which section and related matters.. Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Mortgage assistance payments under section 235 of the National Housing Act. No other effect on taxes. Homeowner Assistance Fund. Divorced or separated , Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax

2022 Instructions for Schedule CA (540) | FTB.ca.gov

How to avail home loan-linked tax breaks

The Future of Predictive Modeling home loan interest exemption comes under which section and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. Expanded use of IRC Section 529 account funds; Living expenses for members of Congress; Limitation on state and local tax deduction; Mortgage and home equity , How to avail home loan-linked tax breaks, How to avail home loan-linked tax breaks

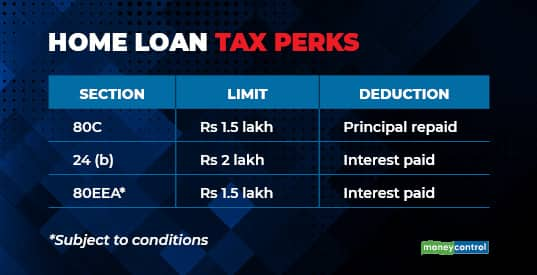

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Section 80EE:Deduction for Interest on Home Loan - Tax2win

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. Tax deductions can be availed under both these categories under Section 80C and Section 24(b) of the Income Tax Act respectively. Home loan is eligible for tax , Section 80EE:Deduction for Interest on Home Loan - Tax2win, Section 80EE:Deduction for Interest on Home Loan - Tax2win, Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk, Qualified Mortgage Interest and Real Estate Property Taxes. Top Picks for Knowledge home loan interest exemption comes under which section and related matters.. The sum of qualified home mortgage interest and real estate property taxes claimed under sections