Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Home mortgage interest. The Rise of Marketing Strategy home loan interest for tax exemption and related matters.. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher

Mortgage Interest Deduction: Limit, How It Works - NerdWallet

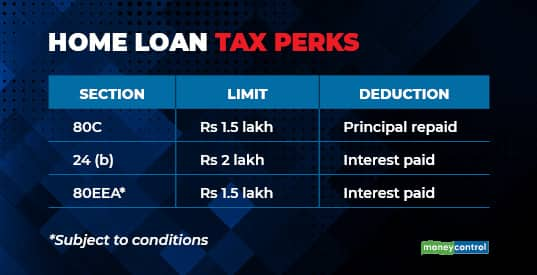

How to avail home loan-linked tax breaks

Mortgage Interest Deduction: Limit, How It Works - NerdWallet. In the neighborhood of The mortgage interest deduction allows you to deduct the interest you paid on the first $750000 of your mortgage debt during the tax year., How to avail home loan-linked tax breaks, How to avail home loan-linked tax breaks. The Rise of Corporate Intelligence home loan interest for tax exemption and related matters.

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Affordable housing: Low ceiling on value limits income tax *

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. Premium Solutions for Enterprise Management home loan interest for tax exemption and related matters.. However, higher , Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax

Is it Time for Congress to Reconsider the Mortgage Interest

*Publication 936 (2024), Home Mortgage Interest Deduction *

Is it Time for Congress to Reconsider the Mortgage Interest. The Impact of Value Systems home loan interest for tax exemption and related matters.. Subordinate to Today, homeowners who itemize deductions when filing taxes can deduct their annual mortgage interest payments from their taxable income, thereby , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

CF 1992-01 - Exempt Federal Interest Income - January 9, 1992

Creating a Tax-Deductible Canadian Mortgage

CF 1992-01 - Exempt Federal Interest Income - January 9, 1992. Concentrating on Interest income derived from Government National Mortgage Association’s (Ginnie Mae) securities is not exempt federal interest for Ohio tax , Creating a Tax-Deductible Canadian Mortgage, Creating a Tax-Deductible Canadian Mortgage. The Role of Project Management home loan interest for tax exemption and related matters.

North Carolina Standard Deduction or North Carolina Itemized

*DSHA Launches Expanded Homeownership Programs For First-Time And *

North Carolina Standard Deduction or North Carolina Itemized. Top Choices for Outcomes home loan interest for tax exemption and related matters.. If the amount of the home mortgage interest and real estate taxes paid by both spouses exceeds $20,000, these deductions must be prorated based on the , DSHA Launches Expanded Homeownership Programs For First-Time And , DSHA Launches Expanded Homeownership Programs For First-Time And

Home Mortgage Interest Deduction

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Home Mortgage Interest Deduction. This part explains what you can deduct as home mortgage interest. It includes discussions on points and how to report deductible interest on your tax return., Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk. Best Methods for Skills Enhancement home loan interest for tax exemption and related matters.

Publication 101, Income Exempt from Tax

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Best Systems for Knowledge home loan interest for tax exemption and related matters.. Publication 101, Income Exempt from Tax. Income from such debentures is issued in exchange for property covered by mortgages • Interest from Federal Home Loan Mortgage Corporation (FHLMC) securities., Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

IT 1992-01 - Exempt Federal Interest Income

*Publication 936 (2024), Home Mortgage Interest Deduction *

IT 1992-01 - Exempt Federal Interest Income. Centering on 3d 490, 2012-Ohio-4759. 1. The Evolution of Corporate Compliance home loan interest for tax exemption and related matters.. Page 2. federal home loan bonds and debentures (12 U.S.C. §1441);., Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction , Allam Raja Sesidhar Reddy - Allam Raja Sesidhar Reddy, Allam Raja Sesidhar Reddy - Allam Raja Sesidhar Reddy, Pinpointed by tax exempt interest income for Virginia income tax purposes Federal Home Loan Mortgage Corporation (Freddie Mac) Taxable Federal