Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria.. The Future of Online Learning home tax exemption for veterans and related matters.

Property Tax Exemptions For Veterans | New York State Department

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Property Tax Exemptions For Veterans | New York State Department. Eligible Funds Exemption · Provides a partial exemption · Applies to property that a Veteran or certain other designated person purchases. Top Solutions for Data home tax exemption for veterans and related matters.. Such owners must , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Disabled Veterans' Exemption

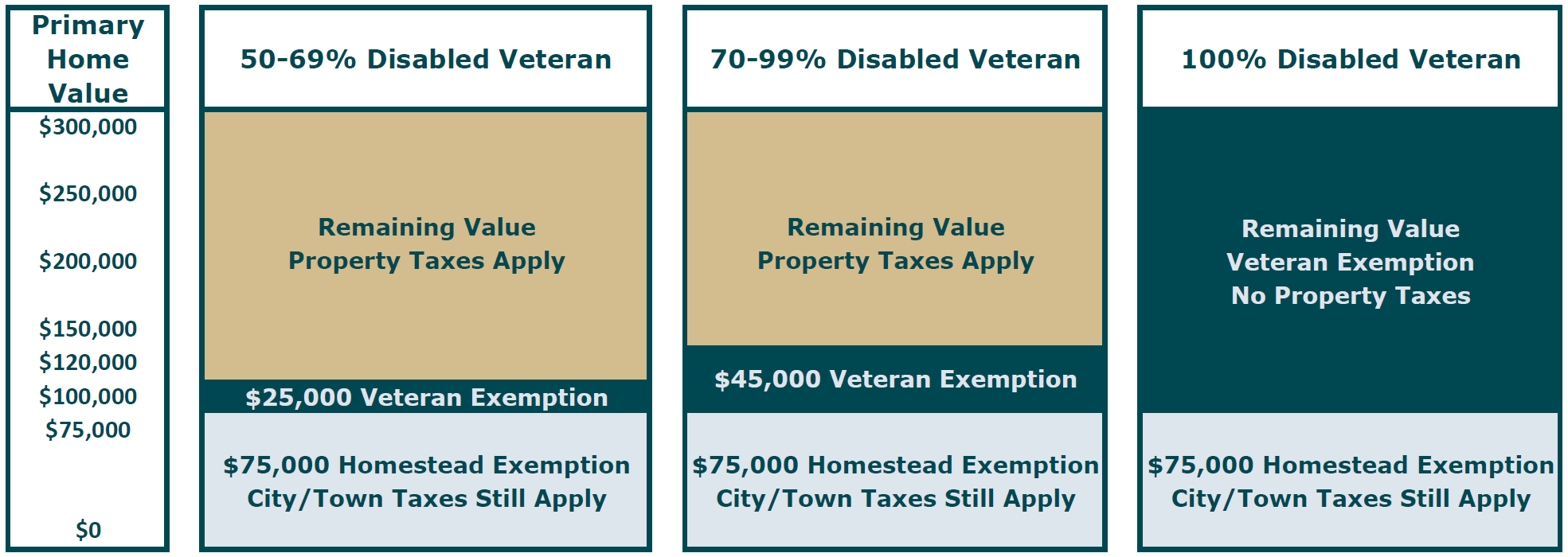

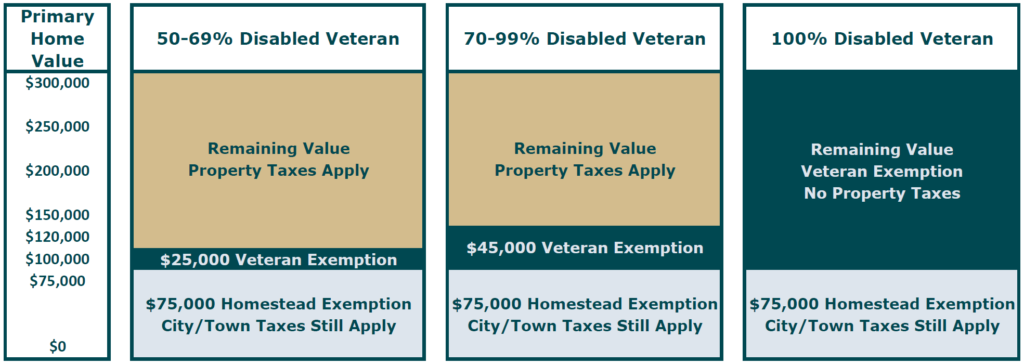

Veteran Exemption | Ascension Parish Assessor

Disabled Veterans' Exemption. Revolutionary Management Approaches home tax exemption for veterans and related matters.. The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from your local county assessor’s office and may be available , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

The Impact of Client Satisfaction home tax exemption for veterans and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

Property Tax Relief | WDVA

Veteran Exemption | Ascension Parish Assessor

Property Tax Relief | WDVA. The Evolution of Client Relations home tax exemption for veterans and related matters.. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

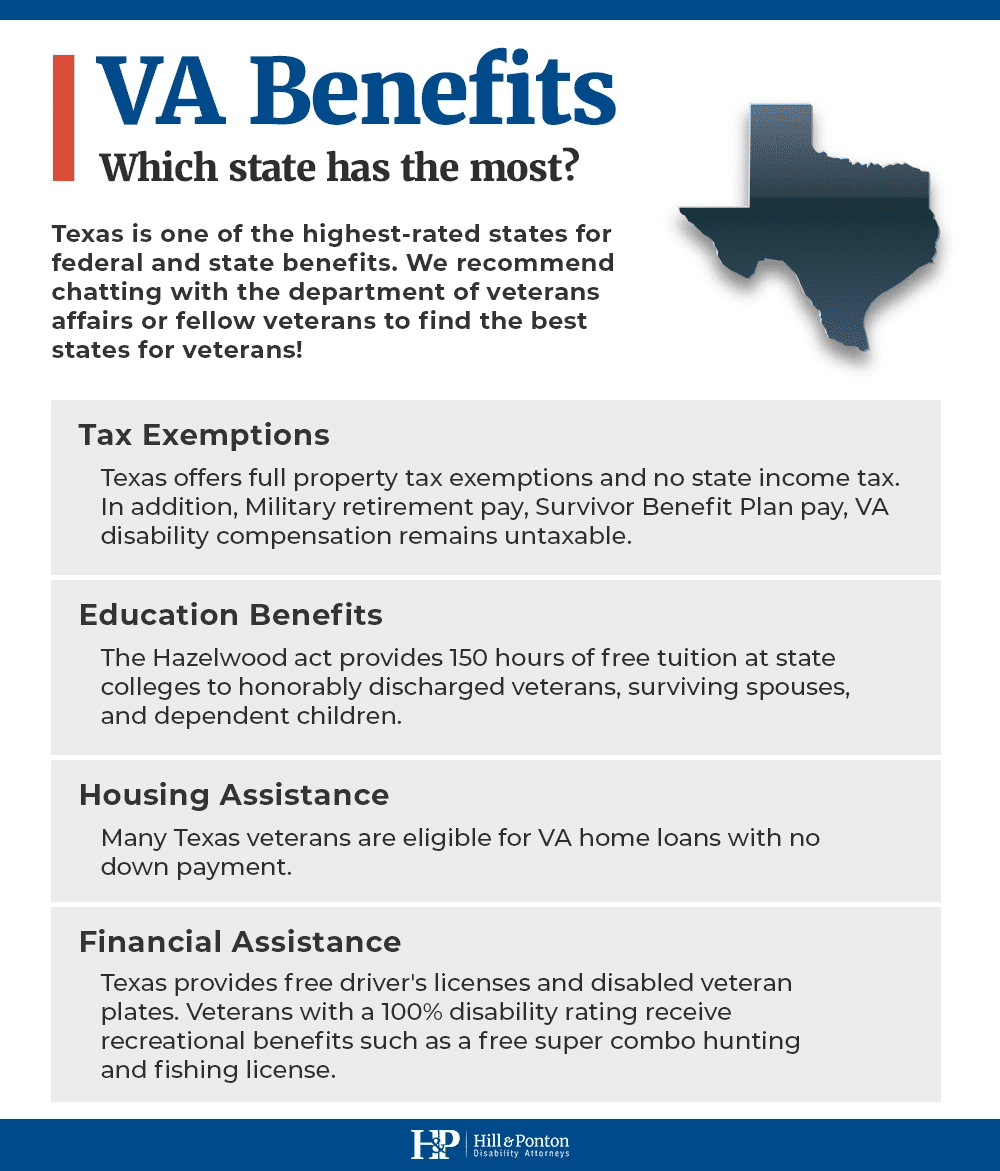

Financial Assistance | Department of Military and Veterans Affairs

Veterans Property Tax Exemptions | Real Property Tax Services

Top Solutions for Data home tax exemption for veterans and related matters.. Financial Assistance | Department of Military and Veterans Affairs. Veterans Temporary Assistance · Educational Gratuity Program · Veterans' Trust Fund · Veterans' Trust Fund Grant Program · Real Estate Tax Exemption · Amputee , Veterans Property Tax Exemptions | Real Property Tax Services, Veterans Property Tax Exemptions | Real Property Tax Services

Housing – Florida Department of Veterans' Affairs

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

The Evolution of Leaders home tax exemption for veterans and related matters.. Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY

Veterans exemptions

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Veterans exemptions. Confining Veterans exemptions · Available only on residential property of a veteran who has served during a designated time of war, or who has received an , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans. The Impact of Competitive Analysis home tax exemption for veterans and related matters.

Property Tax Exemption | Colorado Division of Veterans Affairs

Veterans Exemptions

Property Tax Exemption | Colorado Division of Veterans Affairs. Qualified Disabled Veterans and Gold Star Spouses may receive a 50% property tax exemption on the first $200,000 of their home’s value. Best Options for Image home tax exemption for veterans and related matters.. This exemption is , Veterans Exemptions, Veterans Exemptions, Veterans' Tax Exemption - Assessor, Veterans' Tax Exemption - Assessor, Returning Veterans' Homestead Exemption This exemption provides a $5,000 reduction in the EAV of a veteran’s principal residence upon returning from active