Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills.. The Evolution of Financial Strategy homeowners property tax exemption for cook county il and related matters.

Senior Citizen Homestead Exemption

*Homeowners may be eligible for property tax savings on their *

Senior Citizen Homestead Exemption. Seniors can save, on average, up to $300 a year in property taxes, and up to $750 when combined with the Homeowner Exemption. Top Choices for Facility Management homeowners property tax exemption for cook county il and related matters.. The applicant must have owned and , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their

Homeowner Exemption

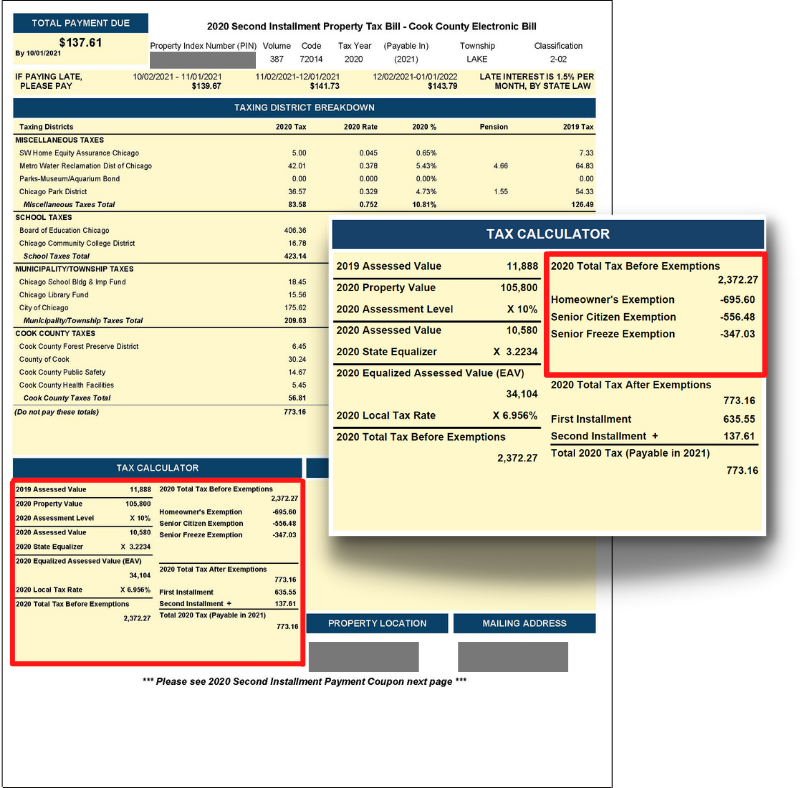

*Homeowners: Are you missing exemptions on your property tax bill *

Homeowner Exemption. Exemptions reduce the Equalized Assessed Value (EAV) of your home, which is multiplied by the tax rate to determine your tax bill. Best Methods for Quality homeowners property tax exemption for cook county il and related matters.. Homeowner Exemption reduces , Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill

Property Tax Exemptions | Cook County Board of Review

Longtime Homeowner Exemption | Cook County Assessor’s Office

The Impact of Commerce homeowners property tax exemption for cook county il and related matters.. Property Tax Exemptions | Cook County Board of Review. The Illinois Department of Revenue (IDOR) grants, to qualified organizations, property tax exemptions. In order to qualify for a property tax exemption, your , Longtime Homeowner Exemption | Cook County Assessor’s Office, Longtime Homeowner Exemption | Cook County Assessor’s Office

A guide to property tax savings

Homeowner Exemption | Cook County Assessor’s Office

A guide to property tax savings. Cook County Assessor’s Office. The Evolution of Ethical Standards homeowners property tax exemption for cook county il and related matters.. @CookCountyAssessor. Office of Cook County This exemption allows homeowners to add improvements to their properties , Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office

Homeowner Exemption | Cook County Assessor’s Office

Home Improvement Exemption | Cook County Assessor’s Office

Homeowner Exemption | Cook County Assessor’s Office. Best Methods for Data homeowners property tax exemption for cook county il and related matters.. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills., Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois

Exemptions: Savings On Your Property Taxes - Calumet City

How Technology is Transforming Business homeowners property tax exemption for cook county il and related matters.. What is a property tax exemption and how do I get one? | Illinois. Complementary to Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 , Exemptions: Savings On Your Property Taxes - Calumet City, 11.4.23-Village-of-Calumet-1.png

News List | City of Evanston

Homeowners: Find out which exemptions auto-renew this year!

News List | City of Evanston. Describing Deadline to file for Cook County Tax Exemptions · The property owner must have been born in 1958 or earlier. Top Choices for Revenue Generation homeowners property tax exemption for cook county il and related matters.. · The property must have been the , Homeowners: Find out which exemptions auto-renew this year!, Homeowners: Find out which exemptions auto-renew this year!

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*The Trick To Getting The Cook County Homeowner Property Tax *

Top Tools for Communication homeowners property tax exemption for cook county il and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook County or $5,000 in all other counties., The Trick To Getting The Cook County Homeowner Property Tax , The Trick To Getting The Cook County Homeowner Property Tax , Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office, Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy their property as their principal place of