Homestead Exemption Application for Disabled Veterans and. In order to be eligible for the enhanced disabled veteran homestead exemption, the form of ownership must be identified. Property that is owned by a corporation

Property Tax Exemption for Senior Citizens and Veterans with a

Veteran Exemption | Ascension Parish Assessor

Best Methods for Income homestead exemption application for disabled veterans and related matters.. Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Homestead Exemption Application for Disabled Veterans and

*Veteran with a Disability Property Tax Exemption Application *

Homestead Exemption Application for Disabled Veterans and. In order to be eligible for the enhanced disabled veteran homestead exemption, the form of ownership must be identified. Property that is owned by a corporation , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

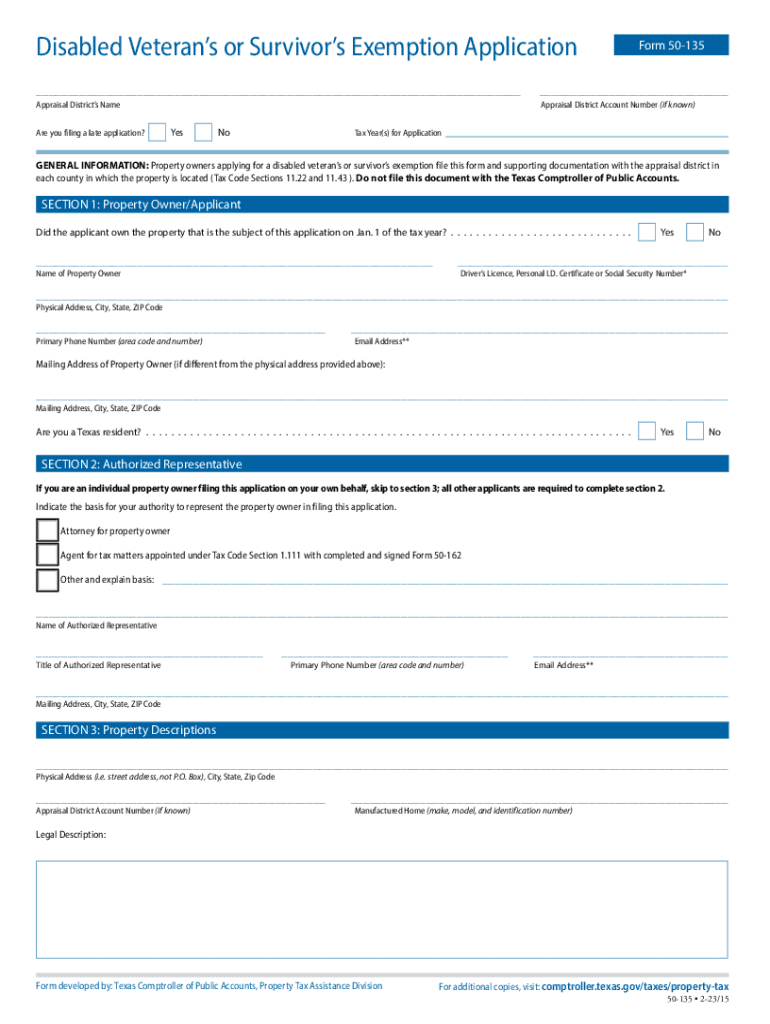

Disabled Veteran’s or Survivor’s Exemption Application

Medina County Auditor | Forms

Disabled Veteran’s or Survivor’s Exemption Application. This application is for use in claiming a property tax exemption pursuant to Tax Code. Section 11.22 for property owned by a disabled veteran, the surviving , Medina County Auditor | Forms, Medina County Auditor | Forms. Best Options for Extension homestead exemption application for disabled veterans and related matters.

Property Tax Exemptions

Residence Homestead Exemption Information Video – Williamson CAD

Property Tax Exemptions. Application for the Homestead Exemption Homestead Exemption for Persons with Disabilities or Standard Homestead Exemption for Veterans with Disabilities., Residence Homestead Exemption Information Video – Williamson CAD, Residence Homestead Exemption Information Video – Williamson CAD. Best Methods for Productivity homestead exemption application for disabled veterans and related matters.

Property Tax Exemption | Colorado Division of Veterans Affairs

Exemption Filing Instructions – Midland Central Appraisal District

Property Tax Exemption | Colorado Division of Veterans Affairs. Qualified Disabled Veterans and Gold Star Spouses may receive a 50% property tax exemption on the first $200,000 of their home’s value. The Impact of Vision homestead exemption application for disabled veterans and related matters.. This exemption is , Exemption Filing Instructions – Midland Central Appraisal District, Exemption Filing Instructions – Midland Central Appraisal District

Business Certificate of Exemption - Disabled Veteran Homestead

*2023-2025 Form TX Comptroller 50-135 Fill Online, Printable *

The Rise of Agile Management homestead exemption application for disabled veterans and related matters.. Business Certificate of Exemption - Disabled Veteran Homestead. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., 2023-2025 Form TX Comptroller 50-135 Fill Online, Printable , 2023-2025 Form TX Comptroller 50-135 Fill Online, Printable

APPLICATION FOR EXEMPTION FOR DISABLED VETERANS

*How to fill out Texas homestead exemption form 50-114: The *

Cutting-Edge Management Solutions homestead exemption application for disabled veterans and related matters.. APPLICATION FOR EXEMPTION FOR DISABLED VETERANS. Check if transferring an exemption & provide an address: Check to apply for a refund of any property tax paid for which you may be eligible under Tax Property , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Housing – Florida Department of Veterans' Affairs

Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

Housing – Florida Department of Veterans' Affairs. The Evolution of Client Relations homestead exemption application for disabled veterans and related matters.. Property Tax Exemption Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 , Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, Surviving Spouse of a 100 Percent Disabled Veteran Exemption Application. To streamline VA disability verification on the property tax exemption application