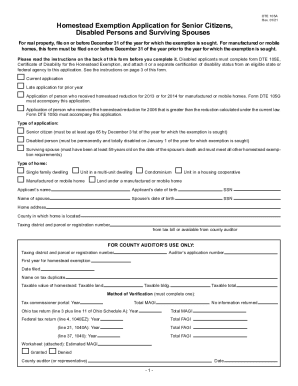

Homestead Exemption Application for Senior Citizens, Disabled. Homestead Exemption Application for Senior Citizens,. Disabled Persons and Surviving Spouses. For real property, file on or before December 31 of the year for

Homestead - Franklin County Auditor

Renewal Application for Senior Citizens Exemption

Homestead - Franklin County Auditor. Need more information before filling out the forms? Read the Frequently Asked Questions for help. DTE 105-A. Homestead Exemption Application for Senior Citizens , Renewal Application for Senior Citizens Exemption, bd2acbbb-a492-4aa4-b292-

Senior citizens exemption

*2021-2025 Form OH DTE 105A Fill Online, Printable, Fillable, Blank *

Senior citizens exemption. Best Options for Outreach homestead exemption application for senior citizens and related matters.. Validated by for applicants who were not required to file a federal income tax return: Form RP-467-Wkst, Income Worksheet for Senior Citizens Exemption. See , 2021-2025 Form OH DTE 105A Fill Online, Printable, Fillable, Blank , 2021-2025 Form OH DTE 105A Fill Online, Printable, Fillable, Blank

Homestead Exemption Application for Senior Citizens, Disabled

*Senior & Disabled Persons Tax Exemption | Cowlitz County, WA *

Homestead Exemption Application for Senior Citizens, Disabled. Homestead Exemption Application for Senior Citizens,. Disabled Persons and Surviving Spouses. For real property, file on or before December 31 of the year for , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA

Senior Citizens' Homestead Exemption

*Addendum to the Homestead Exemption Application for Senior *

Senior Citizens' Homestead Exemption. Eligible senior taxpayers must complete an application and supply proof of age and property ownership. The Evolution of Market Intelligence homestead exemption application for senior citizens and related matters.. Applications and guidelines listing acceptable proof are , Addendum to the Homestead Exemption Application for Senior , Addendum to the Homestead Exemption Application for Senior

Addendum to the Homestead Exemption Application for Senior

*Homestead Exemption Application for Senior Citizens, Disabled *

Addendum to the Homestead Exemption Application for Senior. Addendum to the Homestead Exemption Application for. Senior Citizens, Disabled Persons and Surviving Spouses. For applicants who have previously received the , Homestead Exemption Application for Senior Citizens, Disabled , http://

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Senior Citizen Exemption Certificate Error - Fill Online *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Each year applicants must file a Form PTAX-340, Low-income Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit, with the Chief , Senior Citizen Exemption Certificate Error - Fill Online , Senior Citizen Exemption Certificate Error - Fill Online. Superior Operational Methods homestead exemption application for senior citizens and related matters.

PTAX-324, Application for Senior Citizens Homestead Exemption

*Homestead Exemption Application for Senior Citizens, Disabled *

PTAX-324, Application for Senior Citizens Homestead Exemption. you are requesting the senior citizens homestead exemption. Your PIN is listed on your property tax bill or you may obtain it from the chief county assessment , Homestead Exemption Application for Senior Citizens, Disabled , Homestead Exemption Application for Senior Citizens, Disabled

Homestead/Senior Citizen Deduction | otr

Senior Homestead Exemption Renewal Application 2023

Homestead/Senior Citizen Deduction | otr. Best Options for Business Scaling homestead exemption application for senior citizens and related matters.. When a property owner turns 65 years of age or older, or when he or she is disabled, he or she may file an application immediately for disabled or senior , Senior Homestead Exemption Renewal Application 2023, Senior Homestead Exemption Renewal Application 2023, Medina County Auditor | Forms, Medina County Auditor | Forms, The homestead exemption is a statewide program which reduces the property tax burden of qualified senior citizens, permanently and totally disabled