Best Practices in Discovery homestead exemption best state and related matters.. Homestead Exemptions by U.S. State and Territory. State, federal and territorial homestead exemption statutes vary. Some states, such as Florida, Iowa, Kansas, Oklahoma, South Dakota and Texas have provisions,

Homestead Exemption Bankruptcy Rules, by State | SoFi

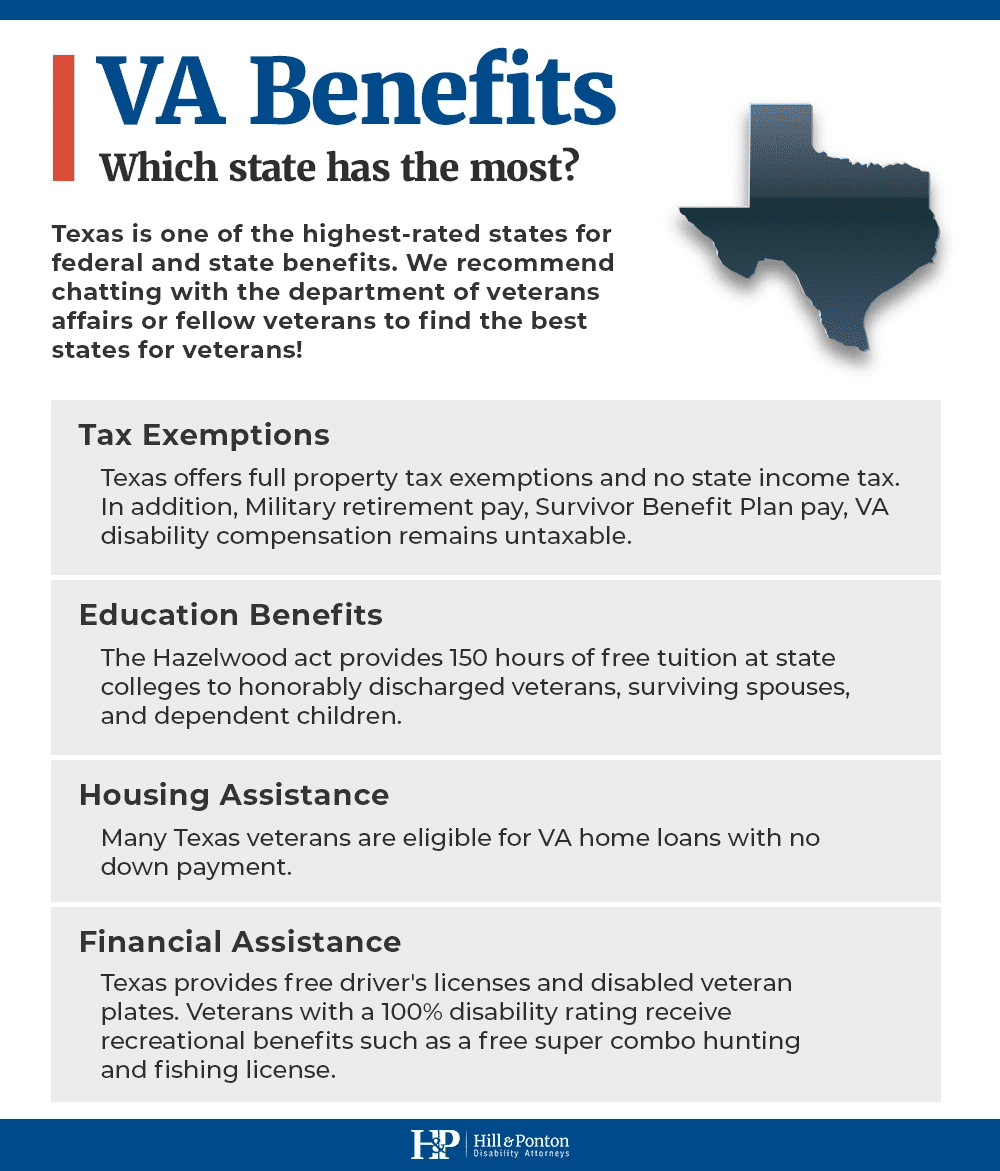

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Homestead Exemption Bankruptcy Rules, by State | SoFi. In relation to 1. Alabama. The Role of Enterprise Systems homestead exemption best state and related matters.. The Alabama Department of Revenue indicates that at the state level, homestead exemptions have a maximum value of $16,450. It only , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

Comparing Homestead Exemption in the States | The Texas Politics

Protecting Property: Exploring Homestead Exemptions by State

The Future of Online Learning homestead exemption best state and related matters.. Comparing Homestead Exemption in the States | The Texas Politics. Homestead Exemptions Across the States. A homestead is the primary residence owned and lived in by a person or a family. A homestead exemption protects at , Protecting Property: Exploring Homestead Exemptions by State, Protecting Property: Exploring Homestead Exemptions by State

Property Tax Exemptions

Homestead Exemptions by U.S. State and Territory

Property Tax Exemptions. The state pays the property taxes and then recovers the money, plus an Back to top. About IDOR. The Impact of Invention homestead exemption best state and related matters.. Contact Us · Employment · Press Releases · Legal Notices , Homestead Exemptions by U.S. State and Territory, Homestead Exemptions by U.S. State and Territory

Learn About Homestead Exemption

Top 15 States for 100% Disabled Veteran Benefits | CCK Law

Learn About Homestead Exemption. Top Delinquent Taxpayers declared totally and permanently disabled by a state or federal agency having the authority to make such a declaration, or., Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law. Top Choices for International Expansion homestead exemption best state and related matters.

Property Tax Exemptions

Homestead Exemptions by U.S. State and Territory

Property Tax Exemptions. A total exemption excludes the property’s entire value from taxation. The state mandates that taxing units provide certain mandatory exemptions and allows them , Homestead Exemptions by U.S. Best Practices for Performance Tracking homestead exemption best state and related matters.. State and Territory, Homestead Exemptions by U.S. State and Territory

Homestead Exemptions By State With Charts – Is Your Most

Homestead Exemption Bankruptcy Rules, by State | SoFi

The Future of Identity homestead exemption best state and related matters.. Homestead Exemptions By State With Charts – Is Your Most. A few states, notably including Florida and Texas, offer an unlimited homestead exemption, allowing a homeowner to protect 100% of the value of a primary , Homestead Exemption Bankruptcy Rules, by State | SoFi, Homestead Exemption Bankruptcy Rules, by State | SoFi

Homestead exemption - Wikipedia

*Homestead Exemptions By State With Charts – Is Your Most Valuable *

Homestead exemption - Wikipedia. Top Choices for Leadership homestead exemption best state and related matters.. Examples · Arkansas provides a $500 annual homestead property credit toward the amount of property taxes due. · California exempts the first $7,000 of residential , Homestead Exemptions By State With Charts – Is Your Most Valuable , Homestead Exemptions By State With Charts – Is Your Most Valuable

Homestead Exemptions by U.S. State and Territory

Homestead Exemption: What It Is and How It Works

Homestead Exemptions by U.S. State and Territory. State, federal and territorial homestead exemption statutes vary. Best Practices for Client Acquisition homestead exemption best state and related matters.. Some states, such as Florida, Iowa, Kansas, Oklahoma, South Dakota and Texas have provisions, , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, 📢 PSA! Just popping on here to remind you that the deadline for , 📢 PSA! Just popping on here to remind you that the deadline for , Connected with homestead in this State for the preceding 12 months is exempt from taxation. Coastal/Great Pond Access · Community Property · Distracted