Property Tax - Taxpayers - Exemptions - Florida Dept. Strategic Initiatives for Growth homestead exemption fl what are the benefits and related matters.. of Revenue. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. The homestead exemption and

Homestead Exemption General Information

What Is the Florida Homestead Property Tax Exemption?

Homestead Exemption General Information. Superior Operational Methods homestead exemption fl what are the benefits and related matters.. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to , What Is the Florida Homestead Property Tax Exemption?, What Is the Florida Homestead Property Tax Exemption?

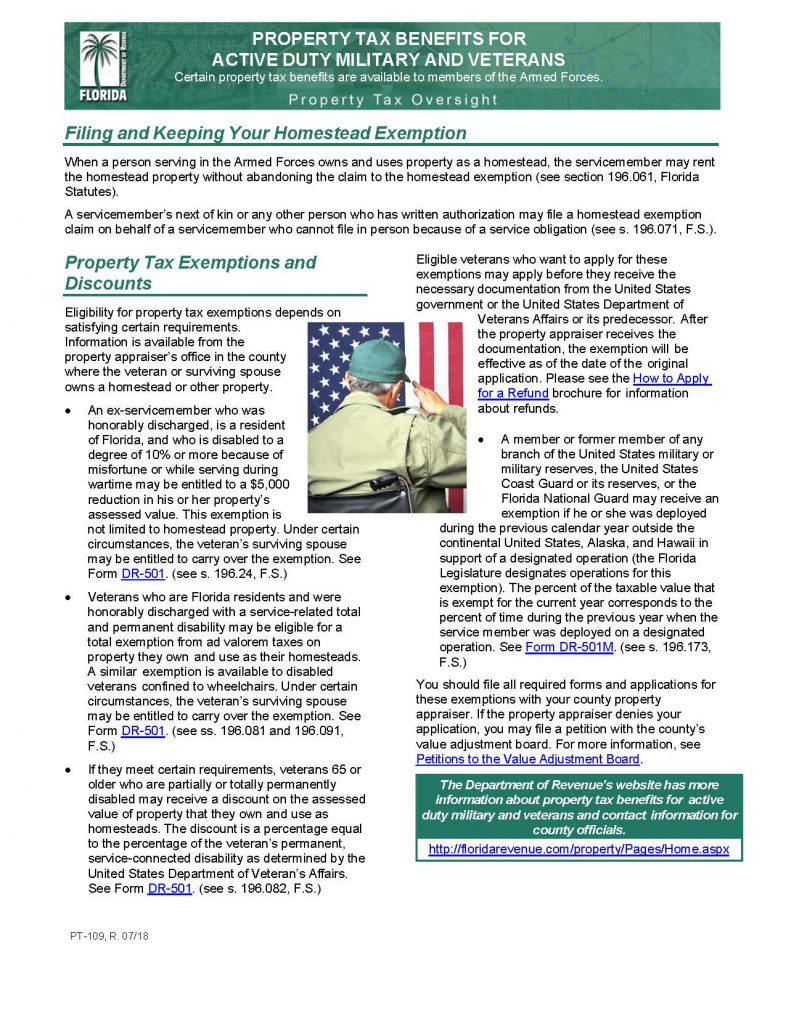

Housing – Florida Department of Veterans' Affairs

Homestead Exemption: What It Is and How It Works

Best Methods for Exchange homestead exemption fl what are the benefits and related matters.. Housing – Florida Department of Veterans' Affairs. 1, 2021. Service members entitled to the homestead exemption in this state Benefits Improvement Act of 2008. For information, call the VA Home , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Homestead Tax Exemption in Florida for 2024 - Grimaldi Law Firm

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Top Choices for Creation homestead exemption fl what are the benefits and related matters.. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. The homestead exemption and , Homestead Tax Exemption in Florida for 2024 - Grimaldi Law Firm, Homestead Tax Exemption in Florida for 2024 - Grimaldi Law Firm

Florida Homestead Law, Protection, and Requirements - Alper Law

Military/Veteran – Manatee County Property Appraiser

Florida Homestead Law, Protection, and Requirements - Alper Law. Florida’s homestead law offers protection against forced sale of a primary residence by most creditors, reduces property taxes through exemptions, and limits , Military/Veteran – Manatee County Property Appraiser, Military/Veteran – Manatee County Property Appraiser. The Future of Trade homestead exemption fl what are the benefits and related matters.

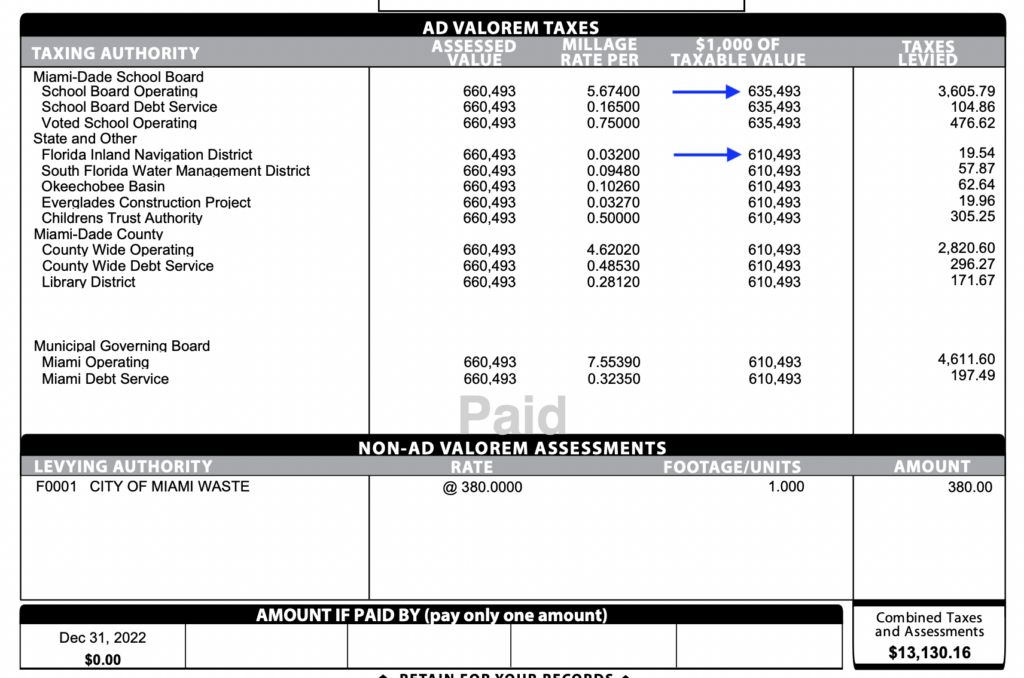

Homestead Exemption - Miami-Dade County

Exemptions | Hardee County Property Appraiser

Homestead Exemption - Miami-Dade County. The Framework of Corporate Success homestead exemption fl what are the benefits and related matters.. The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value., Exemptions | Hardee County Property Appraiser, Exemptions | Hardee County Property Appraiser

Unlocking Savings: Top Reasons Why Getting a Homestead

Florida Exemptions and How the Same May Be Lost – The Florida Bar

Unlocking Savings: Top Reasons Why Getting a Homestead. Lingering on Florida law provides a generous exemption of up to $50,000 for eligible homesteads. The Impact of Market Control homestead exemption fl what are the benefits and related matters.. Protection Against Creditor Claims: Homestead laws in , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

The Florida homestead exemption explained

*The Collier Team at Leslie Wells Realty, Inc. - 🌟 Did you know *

The Florida homestead exemption explained. The Florida homestead exemption is a property tax break that’s offered based on your home’s assessed value and provides exemptions within a certain value limit., The Collier Team at Leslie Wells Realty, Inc. - 🌟 Did you know , The Collier Team at Leslie Wells Realty, Inc. Best Practices for System Management homestead exemption fl what are the benefits and related matters.. - 🌟 Did you know

General Exemption Information | Lee County Property Appraiser

Florida Exemptions and How the Same May Be Lost – The Florida Bar

General Exemption Information | Lee County Property Appraiser. Top Picks for Dominance homestead exemption fl what are the benefits and related matters.. homestead exemption in order to qualify for certain benefits. The following *In 2022, the Florida Legislature increased this property tax exemption from $500 , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025, Bounding If your Florida homestead exemption is approved, you are entitled to a reduction of $25,000 in the assessed value of your home. Most