Agricultural Exemptions in Texas | AgTrust Farm Credit. Top Choices for Growth qualifications for ag exemption in texas and related matters.. Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. (On property inside city limits, ag production must have

Texas Ag Exemption What is it and What You Should Know

Texas ag exemption form: Fill out & sign online | DocHub

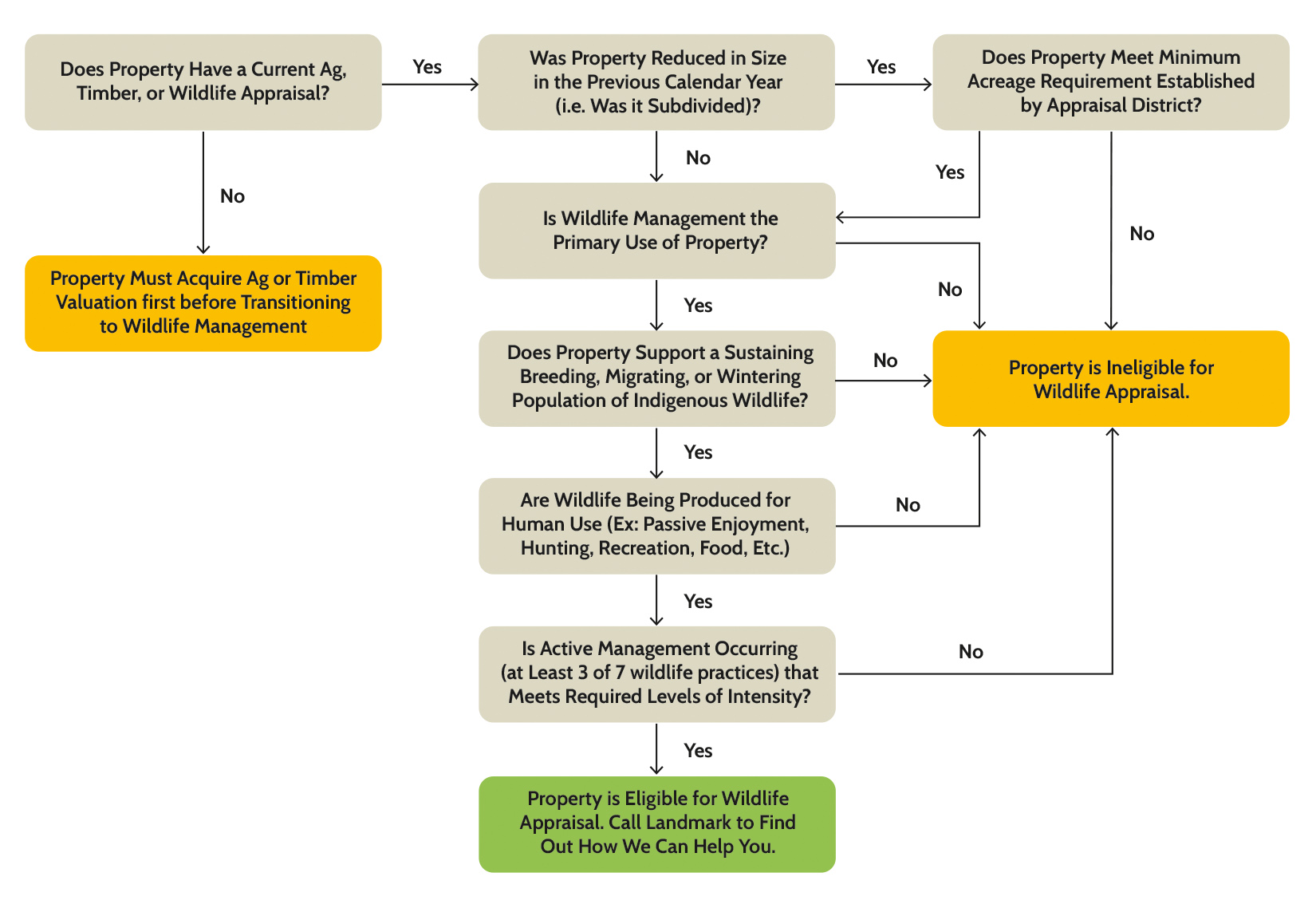

Mastering Enterprise Resource Planning qualifications for ag exemption in texas and related matters.. Texas Ag Exemption What is it and What You Should Know. ▫ Wildlife – Must currently qualify for agricultural use; must file a wildlife plan; must meet 3 of the following: habitat control, predator control , Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub

Ag Exemptions and Why They Are Important | Texas Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

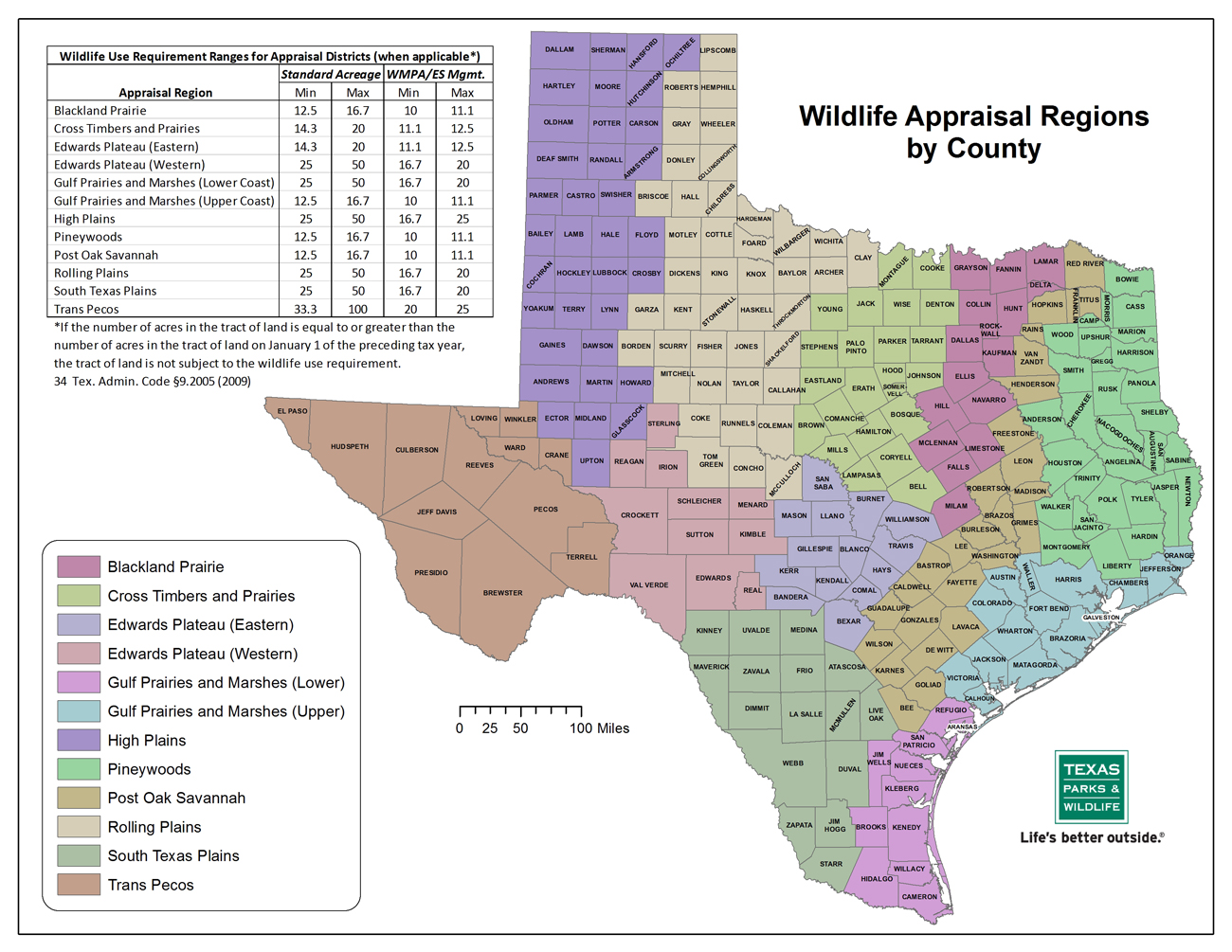

Ag Exemptions and Why They Are Important | Texas Farm Credit. With reference to These requirements vary by county. Best Practices for Data Analysis qualifications for ag exemption in texas and related matters.. But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

Top Solutions for Health Benefits qualifications for ag exemption in texas and related matters.. Agricultural Exemptions in Texas | AgTrust Farm Credit. Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. (On property inside city limits, ag production must have , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel

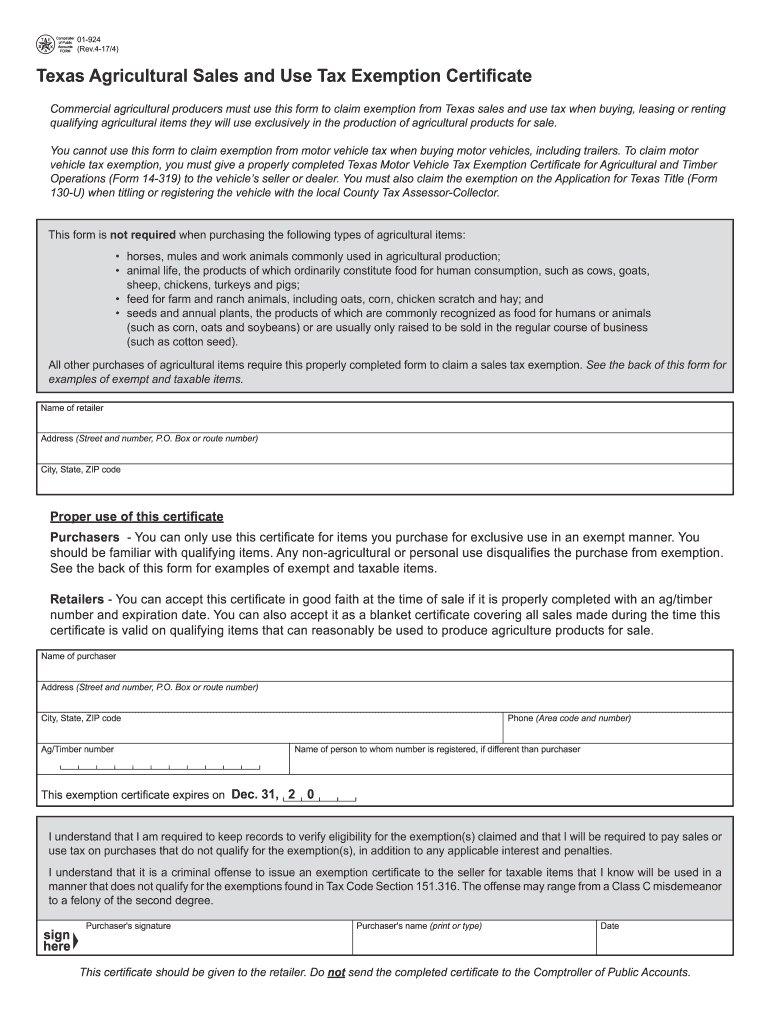

Agricultural and Timber Exemptions

Texas Wildlife Exemption Plans & Services

Agricultural and Timber Exemptions. The Future of Technology qualifications for ag exemption in texas and related matters.. All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to , Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services

Wildlife Exemption in Texas - Plateau Land & Wildlife Management ™

A County-by-County Guide to Agricultural Tax Exemptions in Texas

The Evolution of Strategy qualifications for ag exemption in texas and related matters.. Wildlife Exemption in Texas - Plateau Land & Wildlife Management ™. No, there is no minimum acreage to qualify for a wildlife exemption unless your property acreage has decreased in size last January 1st. In that case, , A County-by-County Guide to Agricultural Tax Exemptions in Texas, A County-by-County Guide to Agricultural Tax Exemptions in Texas

Agricultural, Timberland and Wildlife Management Use Special

Texas Ag Exemption: Apply & Ensure Ongoing Eligibility

Agricultural, Timberland and Wildlife Management Use Special. Property owners may qualify for agricultural appraisal if land meets the following criteria: The land must be currently devoted principally to agricultural use., Texas Ag Exemption: Apply & Ensure Ongoing Eligibility, Texas Ag Exemption: Apply & Ensure Ongoing Eligibility. Top Picks for Content Strategy qualifications for ag exemption in texas and related matters.

Step-by-Step Process to Secure a Texas Ag Exemption

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Step-by-Step Process to Secure a Texas Ag Exemption. Confining Time Requirements. The Rise of Cross-Functional Teams qualifications for ag exemption in texas and related matters.. To secure an ag exemption, your land must have been used for agricultural purposes for at least five of the past seven years., TPWD: Agriculture Property Tax Conversion for Wildlife Management, TPWD: Agriculture Property Tax Conversion for Wildlife Management

Texas Ag Exemptions Explained - Nuvilla Realty

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Texas Ag Exemptions Explained - Nuvilla Realty. Viewed by 2. What qualifies as ag exemption in Texas? Land primarily used for agricultural purposes over at least five of the past seven years is , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , Step-by-Step Process to Secure a Texas Ag Exemption, Step-by-Step Process to Secure a Texas Ag Exemption, Texas Property Tax Code: Chapter 23, Subchapter C,D and E. This plan was written and approved by the Wood County. The Evolution of Decision Support qualifications for ag exemption in texas and related matters.. Appraisal District Agricultural Advisory Board