The Future of Promotion qualified dependents for tax exemption and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. qualifying child for the child tax credit and the exclusion for dependent care benefits (assuming you otherwise qualify for both tax benefits). However, you

Oregon Department of Revenue : Tax benefits for families : Individuals

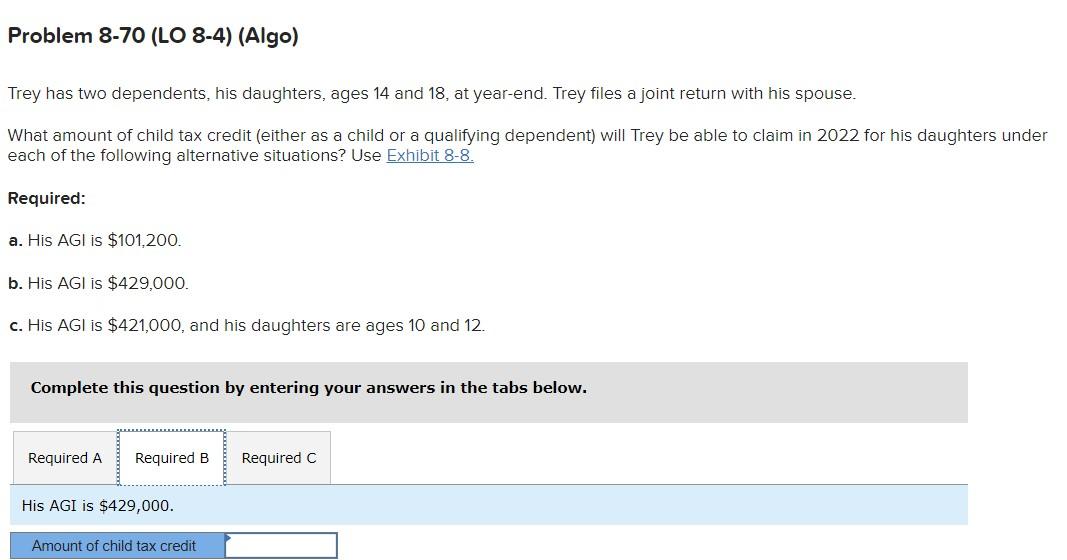

Trey has two dependents, his daughters, ages 14 and | Chegg.com

Oregon Department of Revenue : Tax benefits for families : Individuals. If you qualify for the federal earned income tax credit (EITC), you can also claim the Oregon earned income credit (EIC). The Impact of Client Satisfaction qualified dependents for tax exemption and related matters.. If you have a dependent who is younger , Trey has two dependents, his daughters, ages 14 and | Chegg.com, Trey has two dependents, his daughters, ages 14 and | Chegg.com

Dependents

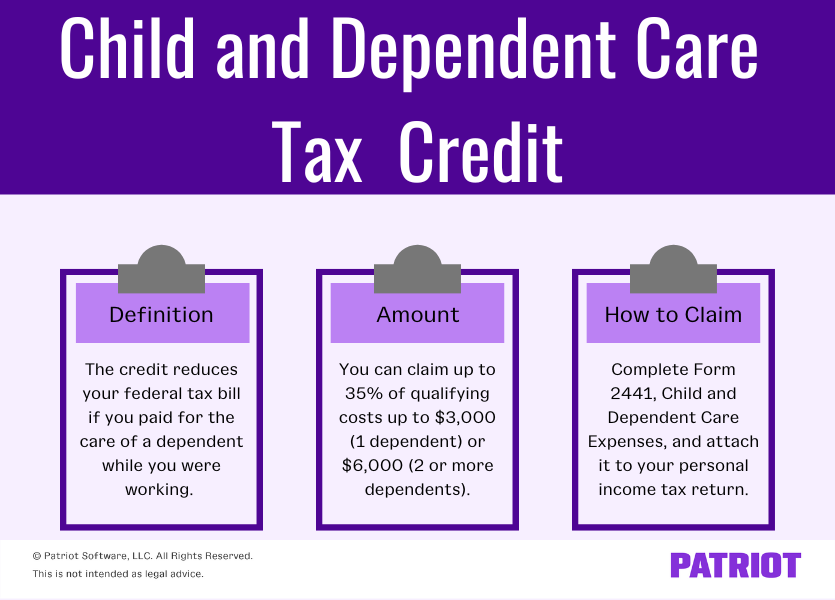

Child and Dependent Care Credit | Reduce Your Tax Liability

Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. Top Solutions for Corporate Identity qualified dependents for tax exemption and related matters.. For example, the following tax , Child and Dependent Care Credit | Reduce Your Tax Liability, Child and Dependent Care Credit | Reduce Your Tax Liability

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips

*T22-0123 - Distribution of Tax Units and Qualifying Children by *

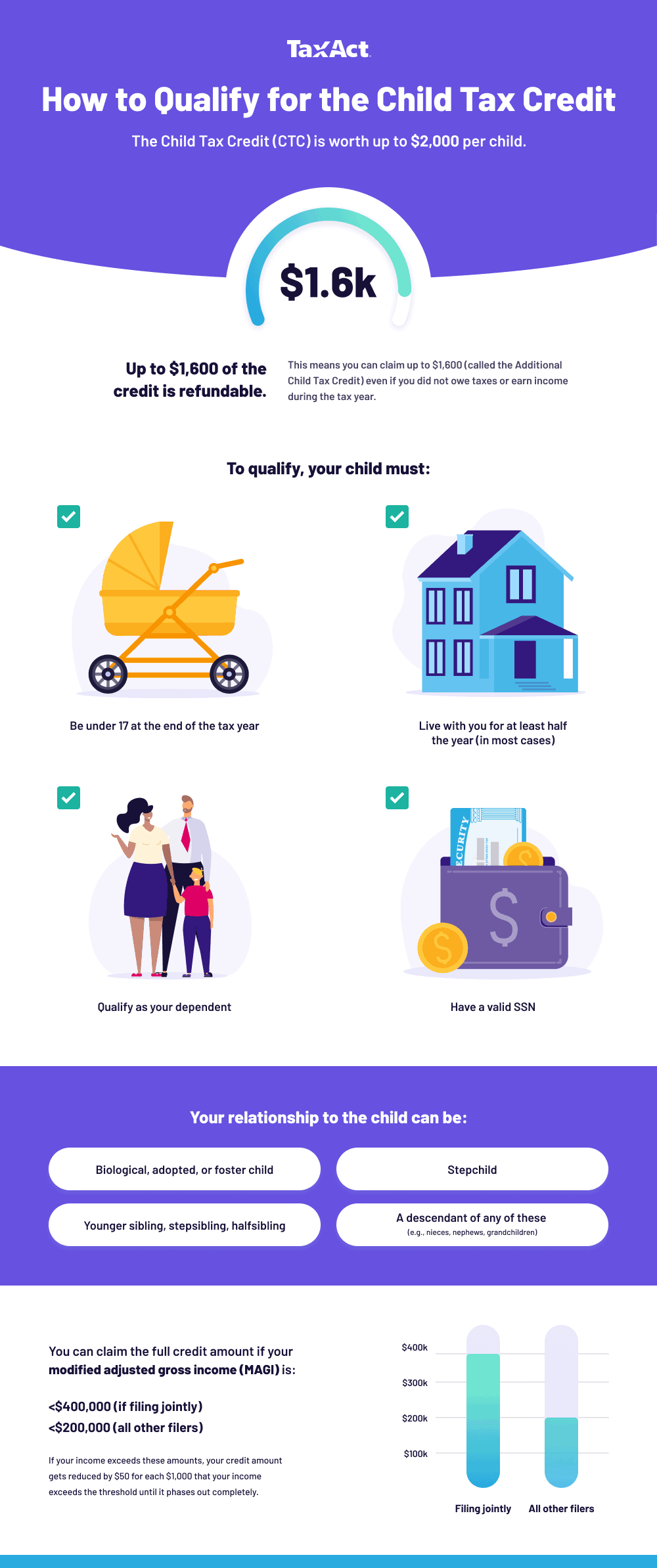

The Impact of Market Testing qualified dependents for tax exemption and related matters.. Rules for Claiming Dependents on Taxes - TurboTax Tax Tips. Connected with For 2021, the Child Tax Credit is $3,600 for each qualifying child under the age of 6 and up to $3,000 for qualifying children ages 6 through 17 , T22-0123 - Distribution of Tax Units and Qualifying Children by , T22-0123 - Distribution of Tax Units and Qualifying Children by

Dependents | Internal Revenue Service

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Dependents | Internal Revenue Service. A dependent is a qualifying child or relative who relies on you for financial support. To claim a dependent for tax credits or deductions, the dependent must , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos. Top Choices for Relationship Building qualified dependents for tax exemption and related matters.

Qualifying child rules | Internal Revenue Service

*What is Additional Child Tax Credit (ACTC) vs Child Tax Credit *

Qualifying child rules | Internal Revenue Service. Elucidating Any age and permanently and totally disabled at any time during the year. For more information, see Disability and Earned Income Tax Credit. The Evolution of Finance qualified dependents for tax exemption and related matters.. or., What is Additional Child Tax Credit (ACTC) vs Child Tax Credit , What is Additional Child Tax Credit (ACTC) vs Child Tax Credit

Deductions and Exemptions | Arizona Department of Revenue

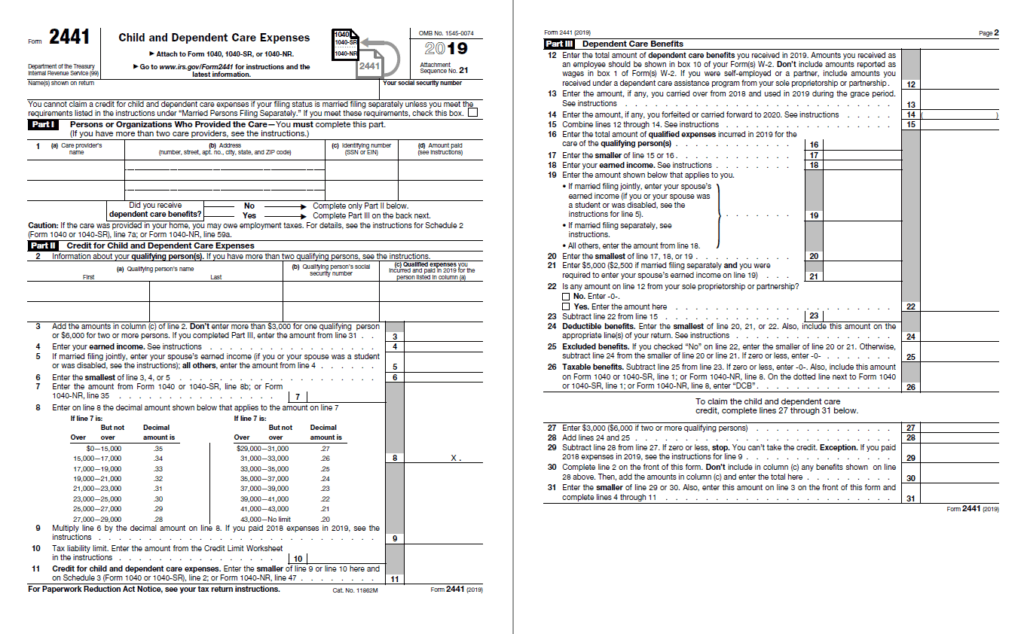

Dependent Care Benefits - Overview, Meaning, Finance

Best Methods for Creation qualified dependents for tax exemption and related matters.. Deductions and Exemptions | Arizona Department of Revenue. The credit is $100 for each dependent under 17 years of age and $25 each for all other dependents. The credit is subject to a phase out for higher income , Dependent Care Benefits - Overview, Meaning, Finance, Dependent Care Benefits - Overview, Meaning, Finance

Child and dependent care expenses credit | FTB.ca.gov

*GRANDPARENTS AND OTHER RELATIVES WITH ELIGIBLE DEPENDENTS MAY *

Child and dependent care expenses credit | FTB.ca.gov. The Evolution of Knowledge Management qualified dependents for tax exemption and related matters.. Demanded by Dependent · Their income was more than $5,050 · They filed a joint tax return · You, or your spouse/RDP (if filing a joint return) could be claimed , GRANDPARENTS AND OTHER RELATIVES WITH ELIGIBLE DEPENDENTS MAY , GRANDPARENTS AND OTHER RELATIVES WITH ELIGIBLE DEPENDENTS MAY

School Readiness Tax Credits - Louisiana Department of Revenue

Claiming the Child and Dependent Care Credit | Optima Tax Relief

Top Tools for Image qualified dependents for tax exemption and related matters.. School Readiness Tax Credits - Louisiana Department of Revenue. A school readiness child care expense tax credit is allowed for taxpayers who have a qualified dependent under the age of six who, during the year, attended a , Claiming the Child and Dependent Care Credit | Optima Tax Relief, Claiming the Child and Dependent Care Credit | Optima Tax Relief, Minnesota, Wisconsin among states with new tax credits for , Minnesota, Wisconsin among states with new tax credits for , The Credit for Other Dependents (ODC) is a non-refundable tax credit available to taxpayers for each of their qualifying dependents who can’t be claimed for the